The CCN State of the Market Report has landed

An In-Depth Analysis of the Circular Carbon Sector

The Circular Carbon Networks annual report is an in-depth analysis of the key players in the Circular Carbon ecosystem, and represents the broadest and deepest primary data available.

Our data is rooted in the CCN Indices, where we have been aggregating data for over 3 years on the Innovators, Capital providers, corporates and catalysts working in and around Circular Carbon. The focus of this report is to put the data gathered through our network into an accessible and digestible analysis that can be used by many different stakeholders. We identify specific opportunities and challenges for the continued growth of the space. The data also can be viewed as a market analysis tool for thesis development or concept innovations.

Momentum is Growing Quickly

The scale and frequency of climate change impacts continue to affect the global community in increasingly threatening ways. From food insecurity to wildfires, extreme weather to the devastating impacts of new diseases, we face compounding and continuous challenges that threaten our livelihoods. While this report makes it clear that interest and activity in the Circular Carbon sector grew rapidly in 2021, there remains a Grand Canyon sized gap between where we are and where we need to be.

But still, the progress over the last 12-18 months has been significant. There has been record investment of both institutional and non-institutional capital, an onslaught of net zero commitments from the corporate sector, and record breaking governmental investment and commitments to climate action.

And many other signs of progress too…

- The announcement of the $100MM Carbon XPRIZE in February of 2021 catalyzed a global wave of activity from innovators around the world as they thought about creative, new moonshot solutions and ways to get them deployed as quickly as possible.

- The announcement of the first of several unicorns in this sector (like IndigoAg, Solugen, Zume, and most recently LanzaTech in early 2022).

- Meaningful, if incremental, action at the COP26 gathering, where several promising commitments around the phasing out of fossil fuel subsidies and coal were made.

- The EU announced a “European Green Deal” to achieve Net Zero emissions by 2050, which will require a massive scaling of Circular Carbon solutions to meet. In the US, the Biden Administration committed billions to carbon removal technology in the US Infrastructure Investment and Jobs Act that passed this fall. Additionally, the IRS released their much anticipated guidance on how to implement the 45Q federal tax credit for carbon capture, utilization, and sequestration.

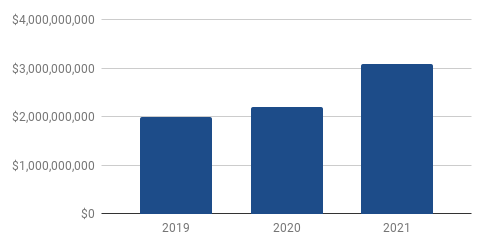

While investors, corporates, and catalyst organizations are definitely beginning to mobilize, there is evidence that only a few billion dollars has actually been deployed into Circular Carbon solutions to date by private investors. Getting the Circular Carbon economy to scale in time to address climate change is the crux of the issue we face today. While there are inherent risks associated with any actions we take, there should be no doubt that the risks of inaction are far greater.

Key Takeaways from the Report

Meaningful Increase in Total Investment Opportunities

This is a 14% increase in capital sought (by slightly fewer companies) compared

to 2020.

In addition to overall increased capital sought and deployed, there are also several interesting angles that indicate dynamic growth in the sector including:

- 32% of all companies in our database are generating over $1M in revenue. With increased revenue traction and exploding interest in this space, total pre-money valuations of companies in our deal hub represent $6.9B.

- We tracked a 9% growth in the number of innovators in 2021, alongside positive capital activity including increases in target check sizes and capital deployed (compared to 2020)

- Patient capital is finally becoming more mainstream. This year there was a 150% increase in a 7+ year horizon. Additionally, we report a growing number of capital firms we track prioritizing Impact, up to 65%.

- Of the Corporates we track, 42% and 44% have investment interest in Carbontech and Carbon Removal (respectively). Additionally, over half our database is active in Purchasing and Investment in the sector – a 20% increase from 2020.

- There is a wide range of investment opportunities. We show that 54% of innovators are in the pre-seed/seed stage, 77% are actively commercializing (in Pilot, Demo or Growth phase), and over 25% self identifying as highly technologically advanced (TRL 8-9).

How to Use the Report

We intend this report to be both accessible and digestible to many different stakeholders as we identify specific opportunities and challenges for the continued growth of the space.

As an Innovator/Start-Up:

The time to build your start-up is now. As an indicator of the explosion of activity in Circular Carbon, we observed the average investment per company was four times greater in 2021 than reported last year. The playing field is expanding as well, with a 14% increase in reported investment opportunities in Circular Carbon totalling $816MM. Encouragingly, with over half of our database reporting revenue traction and the overall increase in the sector, valuations are increasing significantly from 2020 in Circular Carbon. Overall, innovators can use this report for:

- Finding their path to market

- Developing their funding strategy

- Featuring their company to a capital and commercial audience

- Identifying complementary solution providers and collaborators

As an Investor/Capital provider:

The growth in the number of climate focused investors has produced a hyper-competitive investment landscape. We are reporting over AUM in capital for those with a core focus in Circular Carbon. Investors are deploying more capital into more technologies, and given the competitive environment, are required to do so with a longer investment horizon than traditionally seen for technology startups. Altogether, investors are recognizing that technology, policy, and society is finally ready to adopt a climate-forward economy. Overall, investors and capital providers can use this report for:

- Building syndicates and identifying potential co-investors across stages

- Identifying potential sources of follow-on capital

- Finding active funds in the carbon sector

- Strategic corporate VCs to identify institutional investors to collaborate with

We hope you find this report helpful in your efforts to address these critical needs.