The first industrial revolution was driven by the invention of the steam engine and the subsequent scaling of carbon-based energy sources, which dramatically advanced societies around the world. That revolution produced a largely linear system — from resource consumption, to energy use and production, to wastes, notably carbon waste. More than 200 years later, we are now entering an era where we have a chance to create a circular system, in which carbon is no longer merely emitted into the atmosphere as a waste and pollutant that puts society’s gains at risk. New circular carbon technologies that remove CO2 from the atmosphere or from point sources and convert it into valuable products are emerging. We are quietly approaching an inflection point for a modern industrial revolution driven by a suite of these technologies that will reinvent global supply chains and change the way we build, fuel, farm, and produce a variety of goods.

The Circular Carbon Network, an initiative of the NRG COSIA Carbon XPRIZE, exists to help fuel this revolution by connecting entrepreneurs, investors, large companies, and other market catalysts. Our primary mission is to enable capital flow and commercial successes that can lead to reduction and drawdown of CO2 at scale. As we and others help bring this community together, we expect a whole that is significantly greater than the sum of its parts. Building from a decade of seeding activity, this sector is positioned to emerge from its niche to scale in a meaningful way. Several factors have converged to make this a pivotal moment in time.

The Last Decade

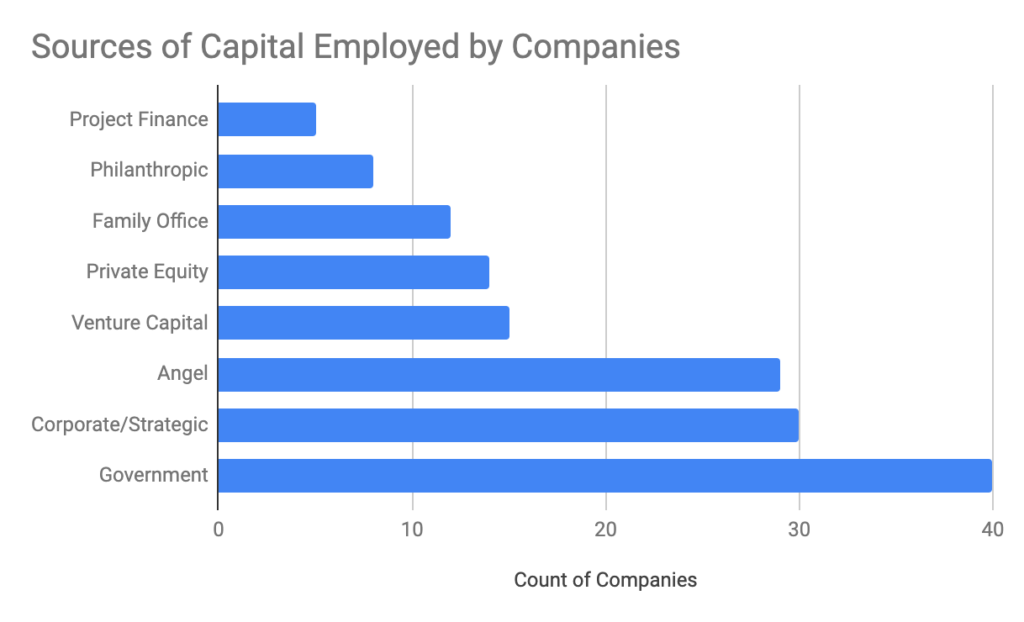

Early Innovators and Adopters. In the past ten years, early market entrants from the startup, capital, and corporate sectors have pioneered circular carbon technologies, investment theses, and commercial business models. More than $2B has been deployed into startups from family offices, VCs, government agencies, Silicon Valley billionaires, big companies, and other capital providers (see Figure 1).

Early Ecosystem. In addition to the Carbon XPRIZE and Circular Carbon Network, new organizations have launched to focus on innovation, R&D, corporate activity, policy, and other key components of a new technology sector. Our focus on capital and commercial scale is complemented by organizations including Global CO2 Initiative, Carbon180, CO2 Value Europe, the Wyoming Integrated Test Center, the Alberta Carbon Conversion Technology Test Centre, Volans, the Center for Global Energy Policy, and others. This ecosystem is beginning to solidify and grow, allowing for experimentation, knowledge share, and commercialization.

Low-Cost Renewables. Since 2009, the cost of wind and solar have decreased ~70% and ~90% respectively. Because clean electricity is often a key input for CO2 conversion technologies, the advent of low-cost renewables dramatically improves cost competitiveness, carbon balance, and business cases for circular carbon technologies.

Increased Recognition and Urgency for Carbon Removal. “All analyzed 1.5°C-consistent pathways use Carbon Removal to neutralize emissions” – IPCC Report, October 2018. To meet Paris Agreement goals, 6 gigatonnes of CO2 per year must be removed from the atmosphere as early as 2030. Additionally, because 45% of global emissions are produced by the industrial and agricultural sectors, Circular carbon technologies are increasingly recognized as an important part of the broader portfolio to stabilize the climate including through permanent removal of CO2 from the atmosphere and oceans.

It’s been said that people overestimate what can be done in a year, but underestimate what can be accomplished in a decade.

We can look to our past to see a glimpse of what the next decade of this revolution can be. As articulated by the XPRIZE, incentive competitions have historically been a powerful force for advancing humanity and creating new markets and sectors, including commercial aviation, telecommunications, and more recently private space travel. In 2020, almost 10 years after it was conceptualized, the NRG COSIA Carbon XPRIZE will award $15M to teams that have captured the most CO2 from point sources and converted it into materials with the highest value. Finalists in the prize are making products that are part of our everyday lives like concrete and other building materials, plastics, advanced materials like carbon fibers and graphene, and synthetic carbon-neutral transportation fuels. All have the potential to be cost-competitive and low-carbon, carbon-neutral, or in some cases carbon negative. We see the prize award as a “Sputnik moment” for circular carbon innovation that has already further galvanized investment, deployment, and attention.

We also have witnessed what can be accomplished within a decade for other climate-related sectors like renewables, EVs, and batteries. For example, Tesla introduced its Roadster in 2008 and by 2018 auto industry incumbents announced nearly $100B in investments in their own EV programs and more than $6.5B was invested into EV related startups from 2010-2017. In 2003, when solar costs were high and market penetration was almost zero, the solar PPA was introduced enabling new scalable business models for financing solar projects. By 2013 in the US, installed capacity was more than 12GW with nearly 70GW installed as of 2019.

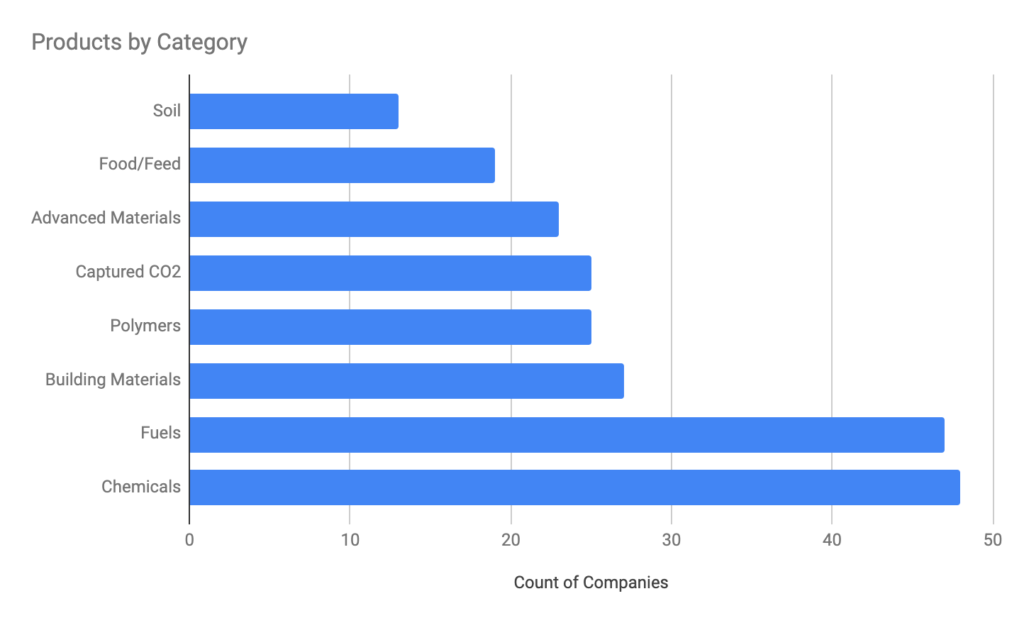

Because this sector is very diverse (see Figure 2), we expect that each CO2 product market segment and CO2 technology will experience its own adoption rate. But as a whole, we are optimistic that the sector is entering a similar decade-long period of cost reduction, technological and business model innovation, and commercial-scale deployment. There is much work to be done, but we believe this modern industrial revolution will reach a tipping point in the 2020s. Carbon-heavy supply chains will begin their reorganization, billions of dollars in capital will be deployed, and new technologies will initiate their path to wide-scale adoption within multi-trillion-dollar markets. Innovation hubs will build around universities, technology R&D facilities, and industrial test centers, while governments will help bring scale via procurement policies and material codes and standards, and students will pursue new career pathways.

We cannot predict the future with precision, but we can and do imagine a robust circular carbon future. To make that vision a reality, we focus on cultivating the ecosystem of innovators, investors, and other leaders who are inventing it. There is both a significant need and opportunity to deploy capital in this sector and we believe knowledge share and a networked community will be critical for realizing this potential. To that end, we have launched a comprehensive Circular Carbon Company Index and Deal Hub, with data on more than 250 technology developers building businesses around the removal and conversion of CO2. For the first time, and with our partners, we have mapped the sector in a single, easy-to-use, investment-focused tool.

We are excited about the next decade and beyond and we invite you to join the community, analyze the index, read our initial analysis of the data, assess the nearly $400M in early-stage deals, engage with us as the XPRIZE develops its new Carbon Removal XPRIZE, and spread the word to your network.