Insights from the Inaugural Circular Carbon Company Index

We are pleased to share the largest public database ever compiled of companies working to capture, use, re-use, and sequester the world’s excess CO2. Our initial survey reveals that over $2 billion has been invested in these “circular carbon” companies to date. As you will see below, this sector is growing rapidly and has the potential to be one of the most important industries of the 21st Century – if we work together to unlock the resources it will need to scale.

Critical Challenge, Massive Opportunity

For over a century, we have powered civilization by digging up carbon-rich fossil fuels and burning them or converting them into the polymers, chemicals, fertilizers, and other carbon-based products that are the foundation of the modern economy. It is now clear, however, that this linear carbon economy (dig, burn, pollute) is no longer sustainable for humanity or our planet.

According to the most recent global studies, scientists now estimate that to avoid catastrophic climate change in the decades to come, we not only need to dramatically and rapidly reduce global emissions of CO2, but by the middle of the century, we will also need to remove billions of tons of CO2 annually that have already been added to Earth’s atmosphere and oceans over the past 150 years. This presents a massive, nearly unprecedented challenge to our species. But it also represents a historic, trillion dollar opportunity, arguably the largest economic opportunity of the next hundred years.

The Circular Carbon Network – Focused on Capital and Commercialization

To help spark the scaling of the sector, XPRIZE partnered with Pure Energy Partners to establish the Circular Carbon Network (CCN). Building on the $20 million NRG COSIA Carbon XPRIZE, which challenges innovators to transform CO2 emissions into valuable products, CCN was established to increase the flow of capital and commercial activity in the circular carbon economy by educating, connecting, and promoting active collaborations between innovators, investors, corporates, and other key stakeholders in the space.

Based on the strong demand for more market data that we heard from our network, CCN has spent nearly a year aggregating the first Circular Carbon Company Index in partnership with other leading organizations in the sector, including Carbon180, the Global CO2 Initiative, and CO2 Value Europe, and with the financial support of XPRIZE and the New York Community Trust. The Index covers over 250 companies that are developing CO2 capture, utilization, and conversion solutions, with data aggregated from a variety of public and online resources, partner data sets, and direct outreach to companies in the sector.

A Growing, Diverse Global Ecosystem, Starting to Attract Capital and Scale

Our analysis of the preliminary data in the Circular Carbon Company Index strongly suggests that, while it is still early days, this sector is beginning to grow, scale, and diversify significantly, creating opportunities for innovators, investors, and commercial partners in many dimensions. Some highlights include:

$2 Billion Invested To Date

Even our limited and clearly US- and European-centric initial survey of the market found that just 89 companies have raised over $2 billion dollars from a wide range of capital providers. While just a snapshot, and a small amount relative to the long term need, it is an encouraging figure given the still-emergent nature of the sector. We intend to fill out and follow this data point closely as we continue to build out the Index.

| Region | Capital Raised to Date |

| Africa | $0 |

| Asia | $45,000,000 |

| Europe | $156,220,000 |

| North America | $1,808,026,000 |

| South America | $0 |

| Oceania | $20,000,000 |

| Total | $2,029,246,000 |

(89 companies reporting)

Top Sources of Capital – Government, Corporates, and Angels

There are a broad variety of capital providers starting to invest in the Circular Carbon sector, but three investor classes clearly stand out: government, corporate strategics, and angels. This suggests that this sector still has some work to do to attract more conventional institutional investors.

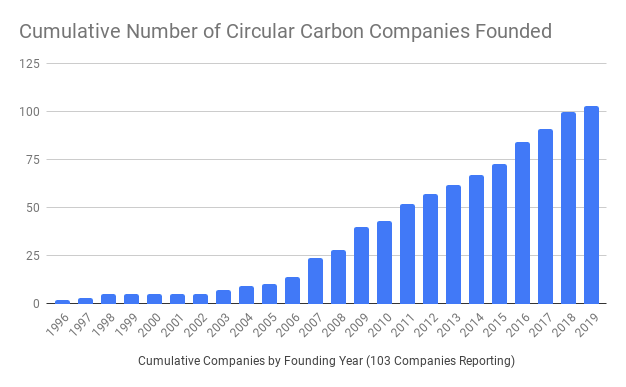

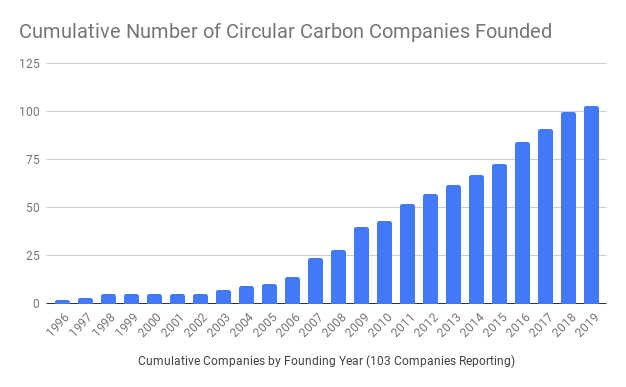

Increasing Company Formation

On a global scale, we also observe significant growth in the number of circular carbon companies founded in the last ten years. 61% of the companies for whom we have founding year information were founded after 2010. Entrepreneurs are now responding at an increasing pace to the opportunity and need. We anticipate this trend will continue.

Diverse Geographies

While our preliminary research was geographically limited primarily to North America and Europe, we found circular carbon company activity across many countries, with some clear leaders starting to emerge. North America is home to over 60% of the companies and nearly 90% of invested capital. Europe follows with 33% of companies and nearly 10% of invested capital.The leading headquarter countries are the United States (129), Canada (23), Germany (17), Netherlands (12), and the UK (11). We recognize that it will be critical to increase our understanding of activity in this sector in Asia, Africa, and South America and plan to add data to the Index from these important regions in the future.

Headquarter Countries

| Region | Count of Companies |

| Africa | 0 |

| Asia | 10 |

| Europe | 85 |

| North America | 152 |

| South America | 0 |

| Oceania | 5 |

Diverse Products and Customers

The product categories and target customer industries of companies in our Index are also quite diverse, with fuels and chemicals (and their respective customer industries) in the clear lead to date, but with several companies providing products in multiple categories and selling to multiple target customer industries.

Capture & Utilization Solutions Often Combined

Examining the types of carbon technologies being pursued by companies in the circular carbon ecosystem, we established a framework that included: (1) Capture & Utilization; (2) Utilization; (3) Capture (Flue) (4) Capture (Direct Air) and( 5) Other.

The results above indicate that many companies in the space do both Capture and Utilization:

- Roughly 50% of companies are pursuing both Capture and Utilization,

- 23% of respondents are pursuing solely Capture (11.3% in Flue and 12.1% in Direct Air)

- Another 22% are pursuing Utilization only.

- Roughly 5% of other companies pursued some alternative technologies such as emission avoidance or enhancement of natural systems.

This indicates that many component technologies are deciding to combine along the value chain. We see a potential parallel to the internet, which required browsers, routers, protocols, fiber optics and other core component solutions to combine to create a whole which was greater than the sum of its parts.

Still Early, but Increasingly Commercial and Mature

We looked at multiple factors to measure the maturity of the emerging circular carbon sector. While it is clearly still early in its evolution, our research shows that companies in the sector span the full range from early stage to growth stage to mature, offering opportunities for capital providers of many types to engage.

Technology Readiness Level

Using the same technology readiness level (TRL) framework as the US DOE, we found that a majority of the companies were either TRL Advanced or Very Advanced:

- A clear majority, 51 out of 95, classified as somewhat advanced or better, at TRL level 6 or above.

- Out of 95 companies, 24 were classified as highly advanced in development at TRL levels 8 or 9.

Revenues

Evaluating revenues, we see the beginnings of revenue traction across the sector. Of the companies for which we have revenue information (78 / 252), over half are generating revenue, and more than 50% of those firms are generating over $1M.

Commercial Stages

Where commercial-stage data is available (123 / 252 companies reporting), roughly 83% of companies are actively commercializing from the pilot phase to growth.

Growing Spectrum of Live Investment Opportunities

In parallel to our Company Index, and in line with our mission to help accelerate capital formation and commercialization, we have developed a Circular Carbon Deal Hub, which tracks active corporate and project investment opportunities in the sector. While only accessible to accredited investors at this time (see requirements and apply to Join as an Investor Member here), we can share a number of macro findings here.

Companies Currently Raising Over $400 Million

We identified a total of 61 companies raising capital during our survey, with 51 companies providing their round sizes for a total value of over $430 million.

Broad Spectrum of Deal Sizes

These investment opportunities break out across a variety of investment stages, offering opportunities for a broad spectrum of capital providers to engage in the sector.

Broad Spectrum of Investors Sought

Similarly, companies in the initial Index are also seeking corporate equity, debt, and project finance from a broad variety of capital providers ranging from Angels to Private Equity.

Variety of Investment Stages, but Still Weighted Toward Early Stage

While there is a wide range of investment opportunities, many of these are currently for companies that are in the early stages of the business, at either a Seed or Series A round.

Why We’re Doing This

By making this dataset available, we are taking a first important step to address the information gap in the market and bring more color and context to the circular carbon sector for all stakeholders. Our hope is that by providing a new landscape view of the sector, as well as identifying real investment opportunities, we can increase interest and engagement in the Circular Carbon space in the form of increased investment and adoption.

How You Can Help

We know this dataset is limited and needs work. Help us refine and expand it, so we can help you better. There are several ways you can support the circular carbon ecosystem:

- Nominate More Companies: If you see a Circular Carbon company (any company with a solution for capturing and/or converting and or using and/or sequestering CO2 from concentrated or atmospheric sources) missing from our Index, please nominate it for our list.

- Send Us More Deals: If you are involved with or know of a circular carbon company raising capital, please tell us about it so we can share it with our Network of accredited investors. Nominate an opportunity here.

- Update Our Data: If you see information about company on our Index or in our Deal Hub that needs updating (data that is missing, incorrect, or outdated), please send us your updates here.

- Join CCN: Join the Circular Carbon Network and be a part of our community. Regular members get access to the full Index database and Investor Members (accredited investors) receive access to the Deal Hub, which tracks Active and Historic deals in the sector. All members get our Newsletter, opportunities to attend invite-only industry events, and early previews of our market data reports and analysis. Membership is free.

- Give Us Feedback: Tell us how we are doing. Share you ideas for how we can work to better accelerate capital formation and commercialization in the Circular Carbon Economy. We’d love to hear from you. Contact Us.