“The transition to a sustainable economy represents the largest investment opportunity we have ever seen particularly for businesses that can contribute to the reversal of global warming.” – Leading Climate Tech Investor

Despite current headwinds caused by COVID-19, “Climate Tech” as a theme is taking hold with key stakeholders. Carbon technology categories like carbon removal, carbon conversion, and direct air capture are growing in visibility for everyone from American politicians in both parties to environmental NGOs to some of the world’s best investors and path-breaking entrepreneurs. Companies like Stripe, Delta, Microsoft and now Amazon are stimulating demand for carbon removal and other solutions, as innovators continue to prove out their technologies. While niche investors and family offices picked up some of the slack left in the wake of the cleantech bubble bursting 2008, new momentum is coming from Silicon Valley, Wall Street, and big corporates. The increasingly apparent and acute effects of an overheated planet (including on human health) require a sense of urgency more than ever before. At the same time, technologies that mitigate and avoid climate change represent the best opportunity to renew global prosperity, reinvent the economy, and create a more resilient society.

Mapping the Capital Landscape for the Circular Carbon Sector

CCN continues its work to cultivate this ecosystem. Using data and networks to accelerate capital flow and commercial activity is core to our thesis. We started by identifying the leading innovators in our Company Index and active investment opportunities in our Deal Hub. To complement these initiatives, we are excited to launch our Capital Index, which showcases climate tech investors either active in circular carbon or at least carbon curious. Our goal is to help investors find collaborators and co-investors and to help entrepreneurs identify investors who might be a fit for their company. Raising money during the best of times is challenging, so our work to support capital flow is even more critical as we face increased economic uncertainty in the wake of the COVID crisis. We look forward to playing our part to support and connect our community during this time and into the future.

Our objectives for the Capital Index:

- Help investors build syndicates and identify potential co-investors across stages

- Help investors identify potential sources of follow-on capital

- Help Limited Partners find funds active in the carbon sector

- Help entrepreneurs find potential sources of capital across asset classes (e.g. equity, project finance, PRIs)

- Help strategic corporate VCs identify institutional investors

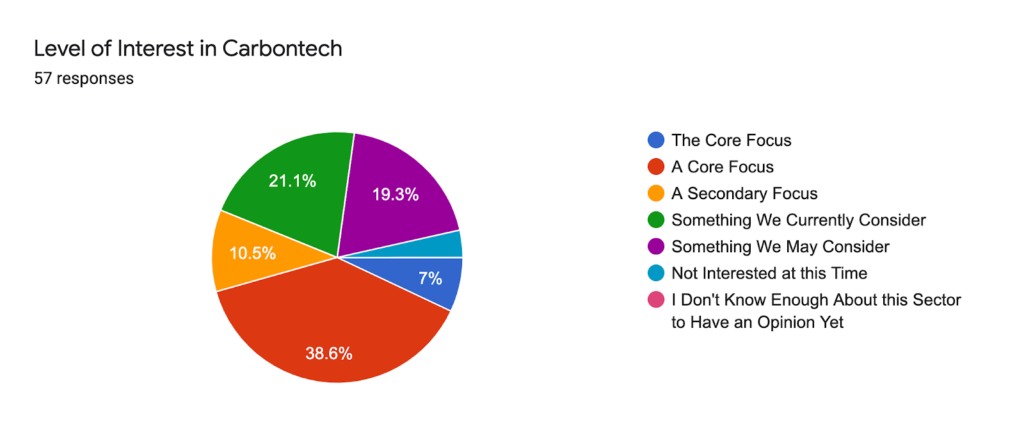

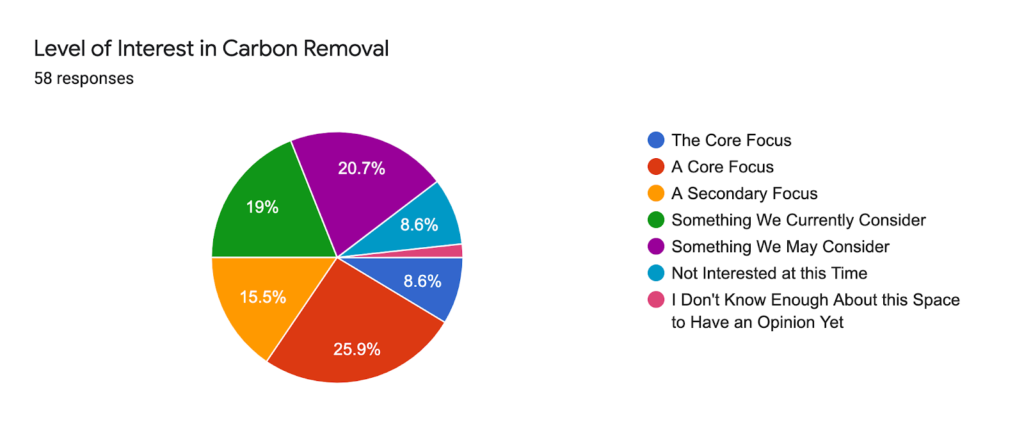

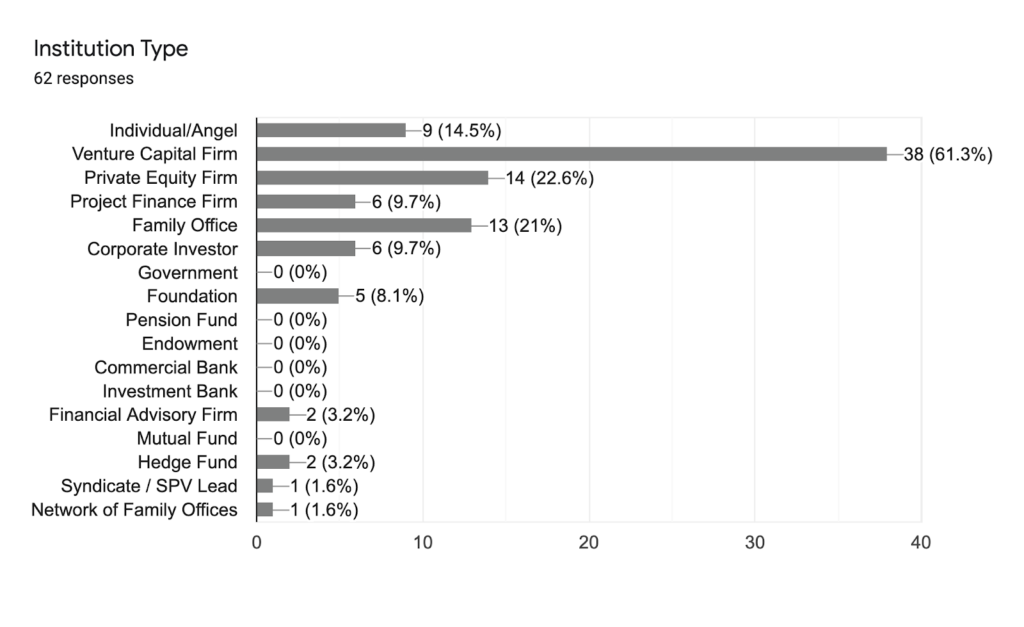

We have been pleased and in some ways surprised by the results of our initial research for the Index. Based on direct surveys to capital providers and our primary research, the launch version of the Capital Index includes 81 leading global investors, representing more than $177 billion in assets under management (AUM). Over 77% of survey respondents indicated that investing in “Carbontech” (defined as carbon capture and carbon-to-value solutions) was a core focus or something they currently consider. Similarly, nearly 70% indicated that “Carbon Removal” (defined as encompassing both technological and biological approaches to remove CO2 from the atmosphere) investing was an area they were active or interested in.

Highlights from the Initial Data and Outreach

- A broad range of capital sources e.g. angels, VCs, strategics, family offices, project funds:

- Fund sizes range from $7 million to $26 billion

- 22 out of 52 survey respondents (~42%) have deployed capital in a carbontech or carbon removal deal already

- $127MM dollars invested in circular carbon companies so far (more than 40 deals)

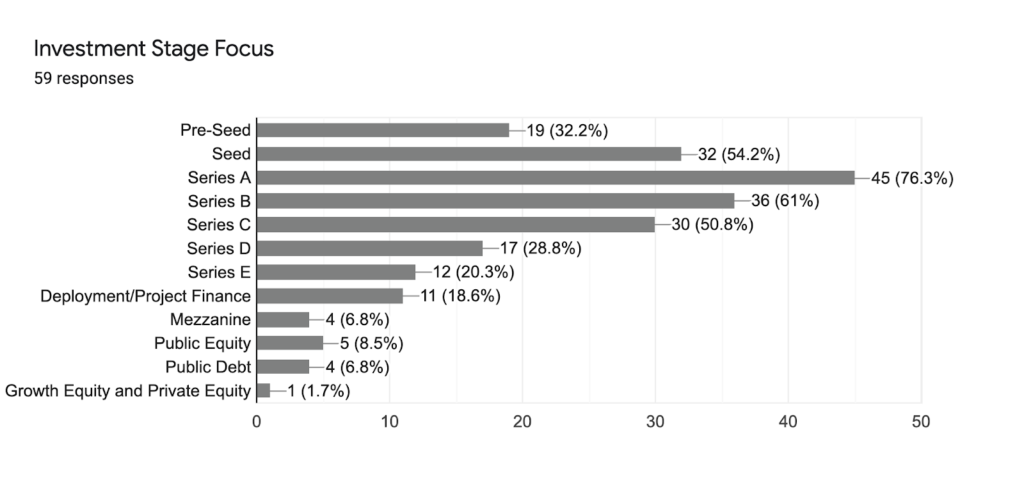

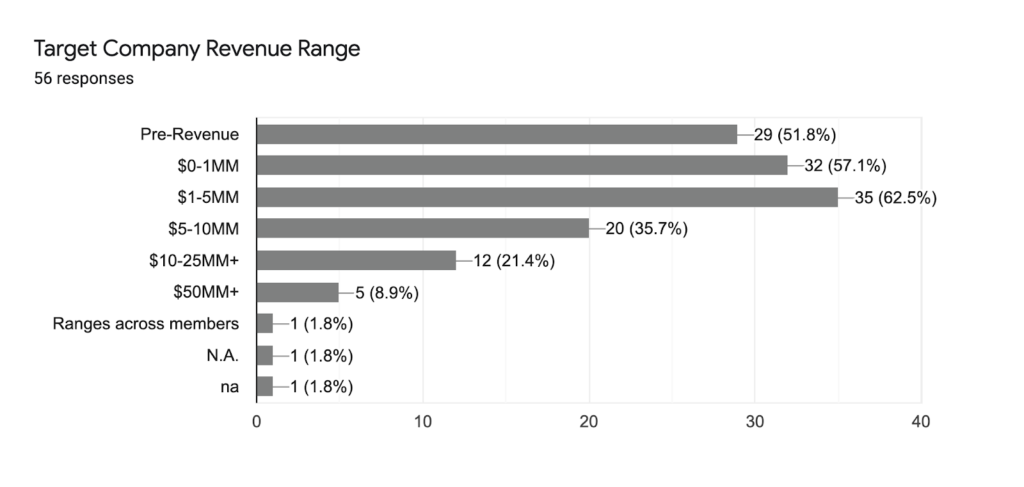

- Stage interest ranges from pre-seed to growth and deployment capital:

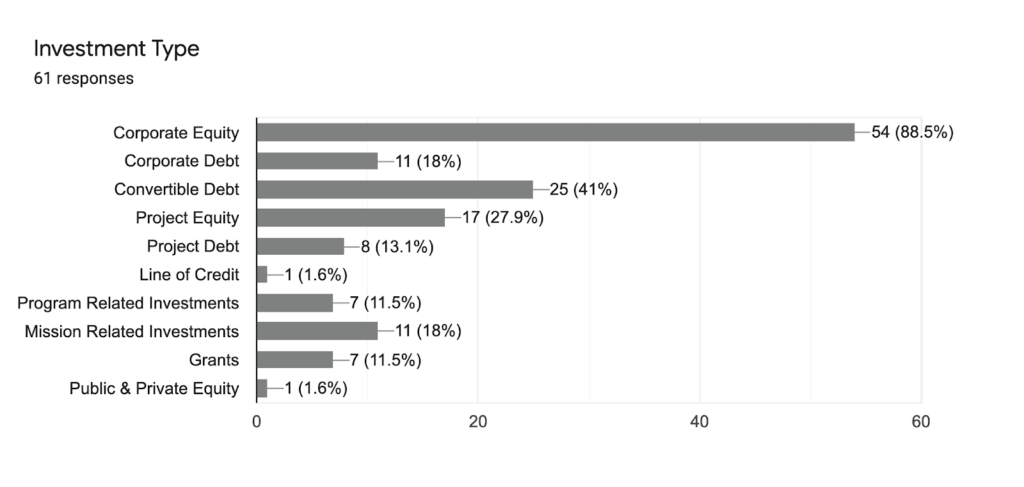

- Investors are looking for deals across a range of instruments:

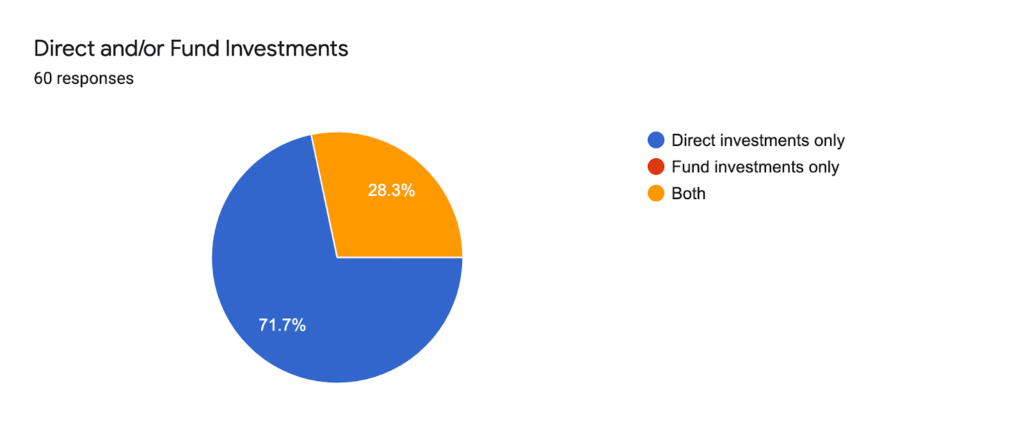

- Most survey respondents focus on direct investments, but 28% also invest in funds:

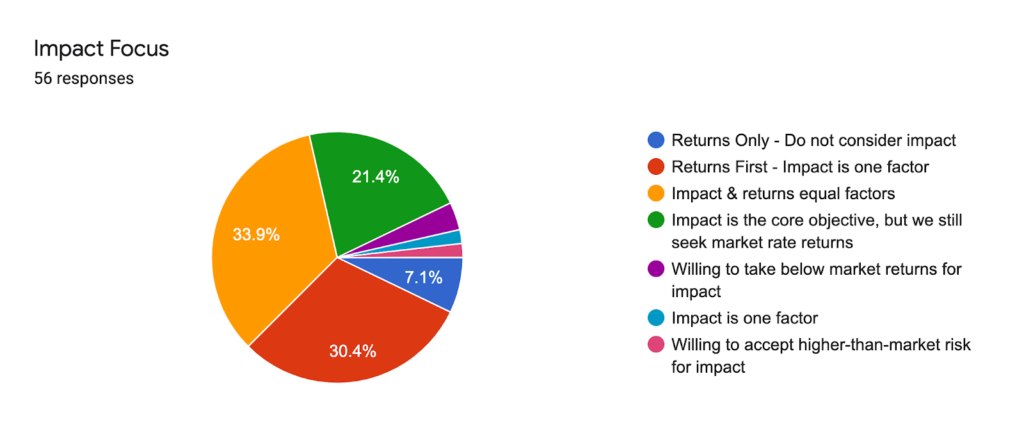

- Impact focus across a spectrum:

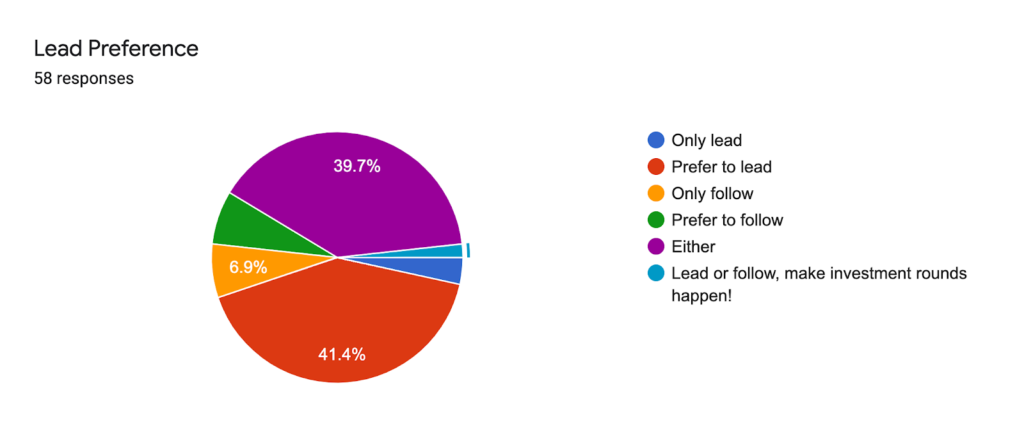

- Syndicate participation generally flexible:

These are just some of the data points that stood out to us in our preliminary analysis of our initial data set. We know that there is a broader universe of investors to identify and assess and plan on adding new investment organizations and additional data to the Capital Index on an ongoing basis to expand the depth and breadth of its coverage.

We hope that we can play a small but meaningful role in supporting the creation of a self-aware and networked circular carbon investment community that accelerates the deployment of capital in this critical sector.

We welcome your feedback on how we can make the Capital Index most useful to the market. If you’re an investor active or considering this space, we encourage you to add your organization to our index.