On Tuesday, September 24, 2019, we convened the “State of Carbontech” summit along with our gracious hosts at the Canadian Consulate of New York and our partners CO2 Value Europe, Carbon 180, Columbia SIPA Center on Global Energy Policy, and the University of Michigan Global CO2 Initiative.

We looked at the accelerating emergence of the sector from the capital, entrepreneurial, commercial, and policy perspective and were fortunate to have panelists from a variety of backgrounds and perspectives sharing their insights.

Below we summarize highlights and key takeaways from our investor fireside chat. You can see the summary from our vibrant and inspiring entrepreneur discussion here.

Comments lightly edited for length and clarity:

Investor Panel

Left to Right:

David Elenowitz – President of Zero Carbon Partners (investment fund)

Johanna Wolfson – Principal at Prime Impact Fund (early-stage fund)

Alfred Griffin – President of NY Green Bank (state-sponsored financier)

Regine Clement – CEO of CREO Syndicate (family office network)

Nicholas Eisenberger – Circular Carbon Network

What does the investment landscape look like from your vantage point?

“Families with operating business are really well-positioned for investing in this space” – Regine

“Even though it’s a relatively new sector for us, we’re already seeing deals with real business models” – Alfred

“We’re looking at this sector because we are a $40M seed-stage fund with catalytic capital for very early companies with gigaton emissions reduction potential and a pathway to market” – Johanna

“I came from private equity. The world didn’t need me to do another PE deal so I moved my personal focus to climate change. Zero Carbon Partners is a $50M fund focused on investing in scalable carbon technologies. I see investing in this space at an inflection point. A few years ago it was too early and in a few years, people will be priced out because these companies are going to be too valuable” – David

What was your reaction to the data in the CCN Company Index?

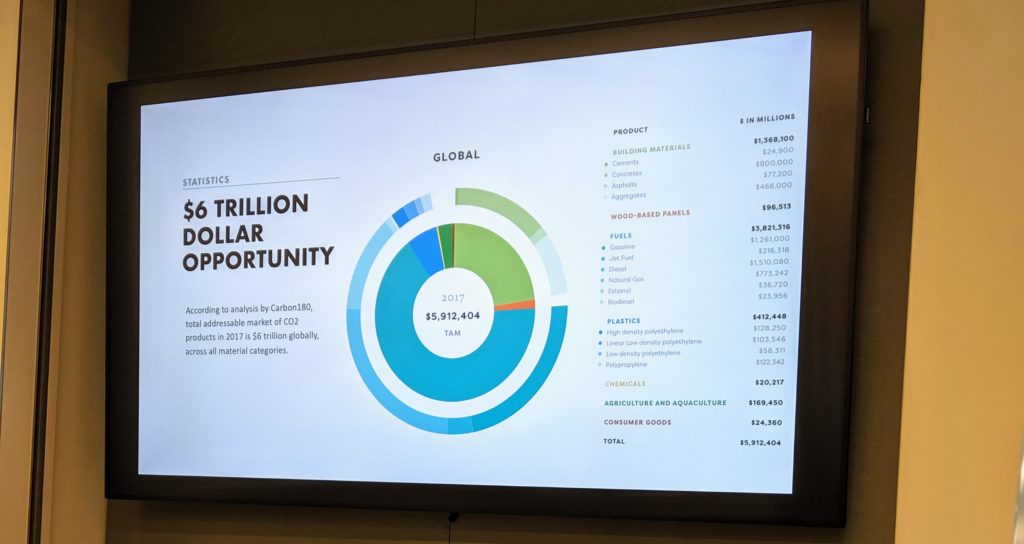

“I personally love the broad diversity of the space but PRIME is focused on what we believe will have the highest greenhouse gas (GHG) reduction potential like building materials and fuels. We want to seed the next generation of technologies and the data helps us identify them” – Johanna

“It is really useful to help understand where the market is and how investors can make money” – Regine

Why is the timing good right now to invest in this sector?

“We’re focused on the second valley of death when proven tech and models are more capital intensive but still too early or small for traditional lenders. We’re excited about what we’re seeing in this category and expect there will be financeable opportunities” – Alfred

“There is enormous pressure on companies from their customers to shift their behavior in this direction” – Regine

“I also think it’s realistic for policy to advance in the coming years and that gets easier if we seed and prove these companies now” – Johanna

“This is not cleantech 1.0. We can test models and technology with much less capital – one or a few million, not $150M. I also think it’s better to be a little early than too late” – David

What markets are particularly interesting to you?

“The revenue opportunity with CO2 conversion is obviously attractive. We like direct air capture (DAC) and soil opportunities, because of the big GHG impact and long-term potential to scale” – Johanna

“Some of our families really care about impact. Mineralization and seaweed cultivation are attracting attention” – Regine

“Take a look at DAC. It’s a really big market and I expect costs to come down significantly with scale. Beyond economies of scale, every time you make a lot more of something, you learn by doing and costs come down meaningfully.” – David

“We’re focused on deals that are asset-based models, driven by purchase orders.” – Alfred

What challenges do you see ahead?

“There are three questions we think about. How likely is it that there will be follow-on capital? What is the first market they can sell to? What’s the policy uncertainty? For our catalytic capital model, we can’t go it alone. We need people with and after us” – Johanna

“Families like to follow leads and ensure there is follow on capital too. “

How can investors accelerate capital formation?

“I have my own capital on the line and I use this credibility to actively connect with other investors about why” – David

“Honestly, I’m blown away by this community and how it’s starting to accelerate with today as an example of that” – Johanna

“Convene five to 10 investors to share information and data on the deals. You can get people who all care about the problem and knowledge-sharing relationships and investment syndicates” – Regine