Contents

TABLE OF CONTENTS

- OVERVIEW

- Summary of Key Findings

- About Us

- About This Report

- INTRODUCTION

- THE INNOVATOR AND DEAL LANDSCAPE

- Key Findings

- Detailed Analysis

- Technology Dimensions

- Commercial Dimensions

- Capital Sources

- Investment Opportunities

- THE INVESTOR LANDSCAPE

- Key Findings

- Detailed Analysis

- Investor Focus Area

- Investor Needs & Engagement

- THE CORPORATE LANDSCAPE

- Key Findings

- Detailed Analysis

- Research & Development

- Invesment

- Purchasing

- Sales

- Project Hosting

- Other

- THE CATALYST LANDSCAPE

- Key Findings

- Detailed Analysis

- Catalyst Activities and Focus Areas

- ACKNOWLEDGEMENTS

2020 Research Results

Compiled by the Circular Carbon Network

TABLE OF CONTENTS

- OVERVIEW

- Summary of Key Findings

- About Us

- About This Report

- INTRODUCTION

- THE INNOVATOR AND DEAL LANDSCAPE

- Key Findings

- Detailed Analysis

- Technology Dimensions

- Commercial Dimensions

- Capital Sources

- Investment Opportunities

- THE INVESTOR LANDSCAPE

- Key Findings

- Detailed Analysis

- Investor Focus Area

- Investor Needs & Engagement

- THE CORPORATE LANDSCAPE

- Key Findings

- Detailed Analysis

- Research & Development

- Invesment

- Purchasing

- Sales

- Project Hosting

- Other

- THE CATALYST LANDSCAPE

- Key Findings

- Detailed Analysis

- Catalyst Activities and Focus Areas

- ACKNOWLEDGEMENTS

OVERVIEW

Summary of Key Findings

The Circular Carbon Network spent a year gathering detailed information about the leading players in the emerging Circular Carbon Economy in a series of living online data Indexes. We believe this is the most comprehensive collection of market data about this critically important emerging sector available anywhere. The purpose of this first-of-its-kind Circular Carbon Market Report is to share an analysis of our data in a way that gives more context, character, and depth to this ecosystem, increases overall societal interest and understanding, and facilitates informed action. We hope you find it useful.

Here are some of the highlights of our analysis:

1. INNOVATOR & DEAL LANDSCAPE

The Innovator Index and Deal Hub

The Innovator Index and its companion database, our Deal Hub, tracks key technology, product, commercial, and capital data about the solution provider landscape for potential investors, commercial partners, and other key stakeholders.

Key Findings

The Circular Carbon innovator landscape is diversifying and growing rapidly. While it is still early days in the evolution of this space, there is a rapidly increasing level, depth, and breadth of overall entrepreneurial activity. There is a broad spectrum of companies from around the world developing and commercializing a highly varied range of innovative Circular Carbon products and solutions for applications in different end markets. Moreover, even though the sector is still relatively young, there are meaningful numbers of companies at all stages of technology maturity, commercial deployment, and revenue generation, from new startups doing their first pilots to successful, growth stage businesses. The same is true for the increasing depth and breadth of the investment opportunities we are seeing on the Deal Hub, where we find a diversity of deals across investment stages, type and size of investments sought, valuations, target investors, and other key factors. There are growing opportunities for a wide variety of investors.

Data Snapshot

332

Companies

27

Countries

$2.2 Billion

Capital Raised

132

Deals Tracked

$714 Million

Investment Opportunity

2. INVESTOR LANDSCAPE

The Capital Index

The CCN Capital Index tracks capital providers who are currently active or interested in Circular Carbon investment opportunities.

Key Findings

The emerging Circular Carbon investor landscape is already quite diverse and includes a broad range of types of investment institutions, types of investments, and size of investments. It also appears to be growing in size, with well over a third of all investment firms we are tracking having been founded in the last five years. Overall, the firms in the Index are managing a significant amount of capital and express a surprisingly high level of general interest in a wide spectrum of Circular Carbon opportunities. However, the lack of specialization and the somewhat limited amount of capital actually deployed into the sector to date indicates that there is significant room for growth.

Data Snapshot

122

Firms

12

Countries

$195 Billion

Assets Under Management

3. CORPORATE LANDSCAPE

The Corporate Index

The purpose of CCN’s Corporate Index is to identify, measure, and characterize corporate activity that meaningfully intersects with the Circular Carbon sector.

Key Findings

While large global companies have been involved in conventional carbon capture research and development for many years, we’re now starting to see a noticeable increase in corporate interest and engagement with a far broader range of Circular Carbon solutions, which is both extremely positive and absolutely essential for the large scale deployment of the circular carbon solutions we need to address climate change in the time available. While corporate intersections points with the sector are still clustered at the “front end” of technology development (R&D and investment in technology developers), there are a growing array of different ways that companies are engaging, from supplying critical components to the market, to commercializing their own solutions, hosting commercial demonstration projects, and collaborating across institutional boundaries. These activities, however, are just emerging and there is evidence that there is still a general lack of strategic clarity about their role in, and the impact on their businesses of, the Circular Carbon Economy. Given the slow pace of change in large organizations, this might be understandable; but it may not be enough.

Data Snapshot

61

Number of corporates

22

Industry Verticals

21

Countries

3.8 Billion

CO2 Emissions (Metric Tons, Scopes 1, 2, 3)

$4.4 Trillion

Revenues

5.3 Million

Employees

4. ENABLING ORGANIZATIONS

The Catalyst Index

The Catalyst Index is designed to help market participants of all types better understand and access the services, expertise, resources, and support that the growing number of enabling organizations in and around the Circular Carbon sector offer.

Key Findings

The emerging Circular Carbon Catalyst ecosystem includes a diverse spectrum of over 23 types of organizations, with the most common being NGO’s, convenors (like CCN), and commercial service providers (like attorneys, consultants, and engineering firms). These organizations are generally modest in size with less than 100 employees, but are also highly focused on the Circular Carbon sector (high levels of commitment to and expertise in the sector), with a majority focused on Carbontech-related issues specifically. They also offer a large array of over 20 different categories of services from data providers to policy advocacy, technology development and demonstration, due diligence, fundraising, and communications. The target core customers and stakeholders of these organizations are primarily entrepreneurs and corporates, but also include capital providers, governments, and the public.

Data Snapshot

67

Organizations

8

Countries

23

Service Types

About Us

Catalyzing Capital for the Circular Carbon Economy

Mission

The Circular Carbon Network is a non-profit initiative that connects the global community of leaders working to transform waste CO2 into a valuable asset for society. Our core mission is to catalyze more investment and commercial activity in this important emerging sector to help accelerate its growth and realize its full, economic and climate potential.

Focus

We do this by educating the market through our research and publications, convening market leaders around critical topics of interest, and catalyzing active collaborations between innovators, investors, corporates, and other key stakeholders in the sector.

Team

The Circular Carbon Network (CCN) was founded by XPRIZE and Pure Energy Partners in 2017 following the launch of the NRG COSIA Carbon XPRIZE. Our matrixed team includes experienced clean economy investors and entrepreneurs, scientists, data specialists, communication professionals, and market researchers.

Join Us

We’ve built a global community of leaders working to scale and grow the Circular Carbon economy. We’d love you to be a part of it. Join here

About This Report

First-of-its-Kind

CCN’s inaugural Circular Carbon Market Report is the first comprehensive and detailed look at the key players in the emerging Circular Carbon market that we are aware of. It is specifically designed to help address the critical needs of this sector.

Built on Unique Databases

Over the past year, CCN has aggregated data about the leading participants in the growing circular carbon ecosystem into several discrete databases or Indexes. These include an Innovator Index (featuring over 300 leading solution developers), a Deal Hub (detailing nearly half a billion dollars of live investment opportunities for accredited investors), a Capital Index (which profiles over 120 active climate, carbontech, and carbon removal investors), a Corporate Index (focused on the growing list of global companies active in the sector), and a Catalyst Index (which tracks the organizations who are the leading enablers of the Circular Carbon Economy, such as service providers, technical experts, and policy advocates).

Focused on Informing and Inspiring Action

This report summarizes the key market trends and insights that we have identified both from the data and the process of gathering it. Our goals are to share, in an accessible, digestible, data-rich format what we have learned about the state and direction of the emerging circular carbon economy; to identify current opportunities and challenges for the continued growth of this space; and, ultimately, to catalyze increased, more informed activity in the space.

Methodology

The data compiled in this Report comes from a broad combination of sources, including detailed reviews by our research team of publicly available information, the generous cross-sharing of market data by our global partners, and self-reported information by direct market participants in response to multiple rounds of targeted surveys that we sent them. We believe it provides a uniquely detailed, first-of-its-kind resource to the marketplace. We also recognize its limitations. We know there are many gaps in our data and in our coverage. The responsibility for any inaccuracies rests with us alone. As the Circular Carbon Network is not a commercial data research service, but a market catalytic, non-profit initiative, we rely on collaboration and data sharing to improve the depth and richness of our Indexes. If you are actively engaged in the Circular Carbon Economy, we invite you to add or update data about your organization here.

INTRODUCTION

From Linear to Circular - Critical Challenge, Massive Opportunity

For over a century, we have powered civilization by digging up carbon-rich fossil fuels and burning them for energy or converting them into the polymers, chemicals, fertilizers, and other carbon-based products that are the foundation of the modern economy. It is now clear, however, that this linear carbon economy (dig, burn, pollute) is no longer sustainable for humanity or our planet.

According to the most recent global studies, scientists now estimate that to avoid catastrophic climate change in the decades to come, we not only need to dramatically and rapidly reduce global emissions of CO2, but we will also need to remove billions of tons of CO2 annually that have already been added to Earth’s atmosphere and oceans over the past 150 years. This presents a massive, nearly unprecedented challenge to our species. But it also represents a historic, trillion dollar opportunity, arguably the largest economic opportunity of the next hundred years. Let’s quickly review the facts…

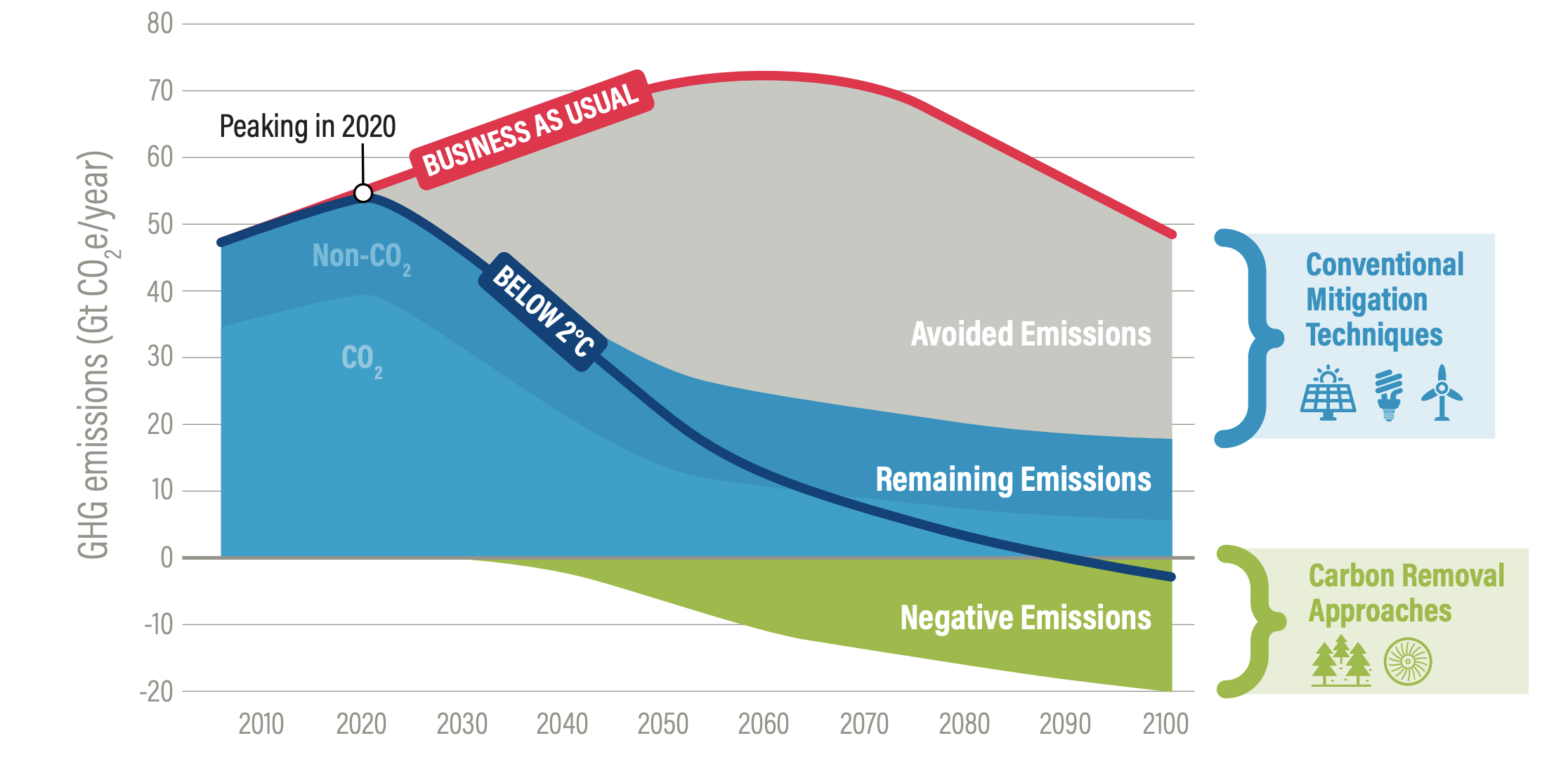

The Carbon Mitigation & Removal Imperative

To limit the increase in average global temperatures to less than 1.5°C above pre-industrial levels, we need to reach “Net Zero” CO2 emissions by 2050 and then move into net negative emissions on a global basis. Thus, we need solutions that BOTH dramatically reduce our ongoing CO2 emissions AND enable us to remove CO2 directly from the atmosphere. How much CO2 are we talking about? The latest UN Intergovernmental Panel on Climate Change report says we need to remove up to 1,000 billion tons of carbon dioxide from the atmosphere by 2100 to avoid catastrophic climate change.

Carbon Mitigation and Removal Both Needed at a Massive Scale

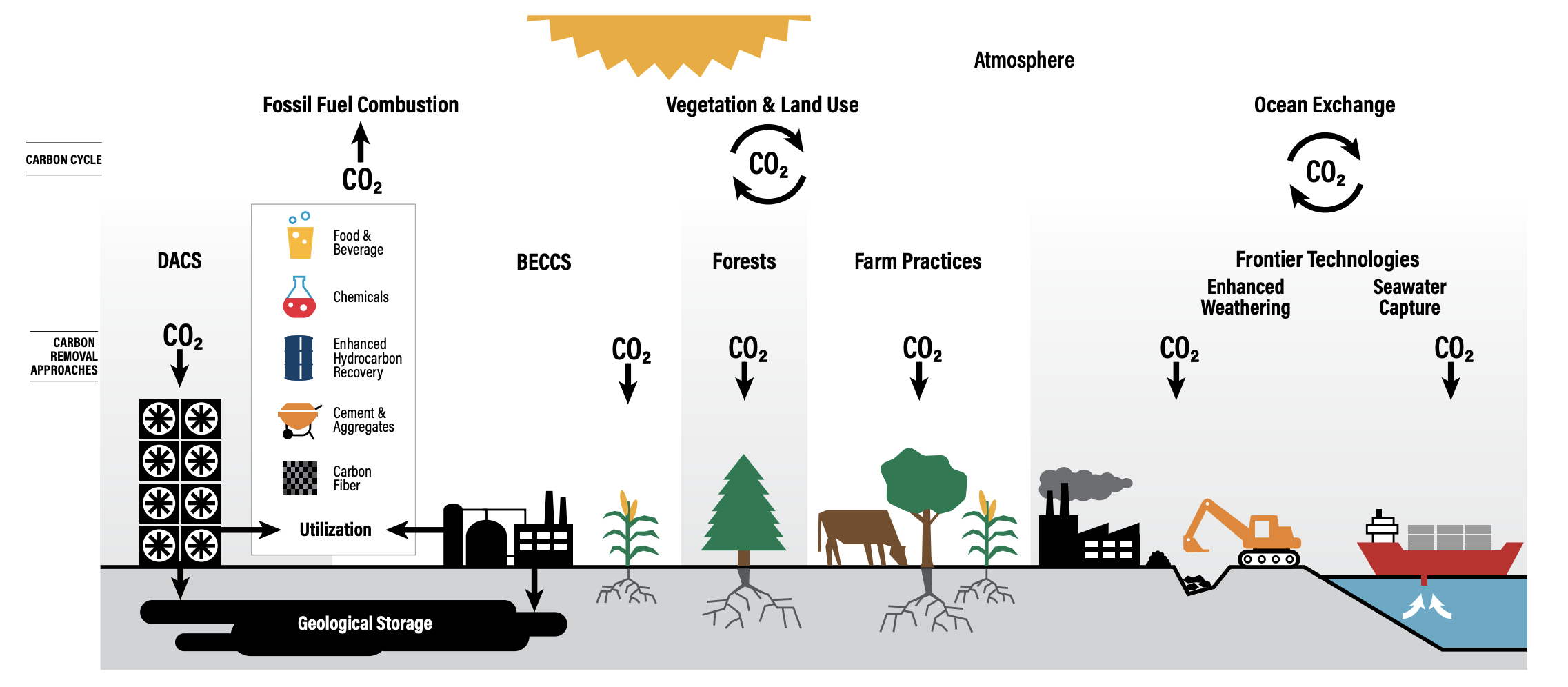

Key Carbon Reduction and Removal Pathways

Reducing and removing that much CO2 will require a broad portfolio of solutions deployed at massive scale, including accelerating the ongoing transition to renewable energy, the electrification of transportation, increasing the energy efficiency of buildings, and reducing deforestation, among others. It will also require carbon capture and storage or utilization of ongoing emissions (key examples include the conversion of CO2 to fuels, soils, chemicals, plastics, building materials, and other advanced materials) as well a full range of carbon removal solutions, from technological approaches like Direct Air Capture (DAC) and Bioenergy Carbon Capture and Storage (BECCS), to biological approaches like reforestation, soil carbon sequestration, and engineered wood (as a substitute for cement and steel), and geological approaches like enhanced weathering and seawater carbon capture, among others.

Circular Carbon Solution Portfolio

Circular Carbon Defined

Amongst the climate solution pathways outlined above, we define “Circular Carbon” as those carbon reduction AND removal solutions that directly take waste carbon-based molecules (typically CO2) and cycle them into other purposes in a way that creates a meaningful climate benefit and, ideally, additional economic or ecosystem benefits. We believe Circular Carbon is a useful umbrella term that ecompasses both “Carbontech” (Technology-enabled means of capturing, utilizing, and/or storing carbon-based GHG molecules, whether derived from the atmosphere or ongoing emissions) and “Carbon Removal” (the durable removal of CO2 from the atmosphere, whether by technological, biological, geological, or other means). We know all too well that the vocabulary in the climate solutions space can be overly arcane, which, in turn, inhibits understanding and action (see our previous report on “Communicating the Value of CO2: Survey Results”). That’s why we deliberately use the broader, common sense Circular Carbon term in our efforts to lens resources and attention to this critically important set of solutions.

Urgent Action Required

Lest we get lost in terminology debates, the urgency of deploying these solutions at scale cannot be overstated. The science tells us that even if we start deploying Circular Carbon solutions at scale today, we still will need to achieve an annual growth rate in reductions and removals of over 55% to avoid a global temperature rise of less than 1.5 degrees celsius. Delaying deployment at scale just five years to 2025 will necessitate an annual growth in future deployment (tons of CO2 per year reduced and/or removed) of 80%. Starting in 2030 means that global carbon reduction and removal capacity will need to double every year! We need to aggressively start deploying both carbon reduction and removal pathways now.

We already have all the facts and solutions. All we have to do is to wake up and change.

Huge Markets

While the scale of the challenge is huge and the time to address it is short, the good news (as further detailed in this Report below) is that many of the Circular Carbon solutions we need already exist or are well under development. Moreover, many of these solutions not only address climate change, but, by converting waste CO2 into useful products or restoring the critical ecosystem services we rely on, actually create significant economic value. Multiple independent studies have laid out the massive market opportunities that a circular carbon economy will create (see our Market Report Library).

To name just a few examples:

- Carbon-to-Value Markets: Our partners at Carbon180 estimate the total available market (TAM) for carbon-to-value products (such as fuels, building materials, and plastics) at $1.07 trillion per year for the US alone and $5.9 trillion globally.

- Direct Air Capture Markets: Similarly, the Rhodium Group estimates that the US demand for industrial equipment for Direct Air Capture could reach more than $1 billion during this decade and up to $259 billion by 2050.

- Jobs: Rhodium also estimates that the equipment and manufacturing for deploying Direct Air Capture plants at the scale required can create between 600,000 to 1.35 million jobs by 2050 in the U.S. alone. On average, a one megaton DAC plant can create more than 3,500 jobs across the supply chain.

- Other Markets: These estimates do not include revenues, profits, or jobs from many other circular carbon pathways not mentioned above, so the economic opportunity is likely far, far greater.

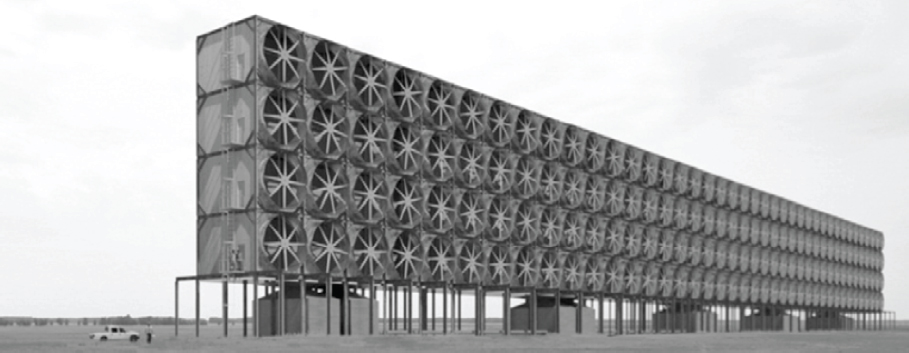

Conceptual drawing for a large Direct Air Capture system (Holmes & Keith 2012)

Investment Need & Opportunity

Estimates vary about the scale of investment required to meet the climate challenge. We know Circular Carbon solutions are generally capital intensive, so the number is not small. But is it really that big? Science tells us we will likely need to remove at least 10 gigatons of CO2 from the atmosphere annually by 2050 (and possibly 2-4X that amount) to avoid warming of greater than 1.5C. If one conservatively assumes a broad upfront capital cost range of between $100 and $1,000 dollars for one ton of carbon removal capacity, the capital investment required for building 10 Gigatons of capacity is (roughly) between $1 trillion and $10 trillion. Since governments spent more than $12 trillion in just the first six months of the COVID-19 pandemic to protect society from further catastrophic damage, these numbers are not shocking to contemplate.

The economic opportunities are extraordinary, which I have not seen in my 35 years of finance.

Moreover, again, investing in addressing climate change is not just an expense. We’re talking about the wholesale transformation of the energy and materials economy worldwide over the coming decades from a linear, fossil carbon-based approach, to a circular carbon-based model powered increasingly by renewable energy. This will both transform existing industries and create whole new ones. While there will be winners and losers and there are clearly significant uncertainties about timing, which technologies will dominate, which markets will flourish, and how quickly policy will support these changes, there should be little question that this will create an enormous new class of opportunities for investors. As we detail in the report below, this has already begun.

Current Situation – Nearing a Tipping Point?

The Circular Carbon economy is at a pivotal moment in its evolution. The level of interest in the sector has increased dramatically over the last two to three years. The science has become even clearer: we face increasing disruption of the world’s natural systems if we fail to take urgent action. The longer we wait, the more CO2 we will have to remove from our atmosphere. The everyday evidence has also become obvious: unprecedented global average temperatures, year after year; dwindling arctic sea ice; record storm and wildfire seasons. Meanwhile, the pandemic has shone a harsh light on what happens when we fail to prepare for a known threat, while also demonstrating how quickly governments and societies can act when determined to do so.

Increasing Momentum

These and other factors are driving more attention than ever before to the critical role that the Circular Carbon sector can play in addressing the climate challenge while creating tremendous social and economic benefits. As you will see in the report below, innovators and quality entrepreneurs are entering the sector at an increasing pace, creating and maturing exciting new solutions. As we will show, investors are also beginning to take note, with “climate tech,” “carbontech,” and “carbon removal” now becoming recognized, even popular, investment themes. Similarly, corporate interest has skyrocketed. As described below, in the last year, there has been a blizzard of corporate announcements — from Microsoft to Shell to Amazon to Delta and more — about achieving “net zero emissions” in the coming decades, nearly all of which rely on circular carbon solutions to get there. Likewise, government policy is starting to reflect and support this growing interest, with the EU passing a “European Green Deal” with significant carbon reduction targets and even the US passing, on a bipartisan basis, changes to the tax code (“Section 45Q”) that provide tax credits for carbon capture, sequestration, and utilization. The media, of course, has also taken note…

What if carbon removal becomes the new Big Oil?

Ongoing Challenges

While this is all very positive, it is not yet enough. The clock is ticking relentlessly. When science tells us we have approximately a decade to bend our current trajectory away from potentially catastrophic climate outcomes, the progress we can make (or fail to make) over even a few months matters. While investors are definitely taking note, there is evidence, as you will see from our report below, that just a few billion dollars has flowed into circular carbon solutions to date from private investors. This is not nearly sufficient to either the need or opportunity. And indeed, there are real technical and economic questions about what solutions will work, when, if ever.

There is also the challenge of how Circular Carbon solutions will support a just and equitable transition to a more sustainable, resilient economy. Public perception and public acceptance of these solutions is critical if they are to be developed to their full potential and deployed at scale. Getting there must first involve broad outreach to a range of stakeholders beyond the usual technocratic circles. Executing a shift to a Circular Carbon economy is too large of an effort to be carried out by a small community of technologists and investors, and a path forward that places emphasis on equity and justice as well as cost and technical performance is likely the most fruitful.

Though the path ahead is not without its challenges, including the risks associated with any actions we take, there should be no doubt that the risks of inaction are far greater.

Critical Needs

To achieve its full potential, the Circular Carbon sector needs to rapidly advance and mature on several key fronts:

- Ongoing Innovation: Continue to attract talented and experienced entrepreneurs who can identify and bring to market additional breakthrough solutions

- Accelerated Scaling: As you will see below, there are already a large number of potentially viable solutions being developed. These need the resources and partners to be able to test and demonstrate their capabilities at increasing scale

- Increased Capital Support: In that vein, the amount of capital flowing into the space needs to dramatically increase, soon. For that to happen, investors need to have confidence that there are quality companies with a realistic path to commercial viability in a reasonable time frame

- Commercial Deployment: Successful deployments will do more than perhaps anything else to catalyze more societal resources to this sector and bring the Circular Carbon solutions we need down the cost curve so they can be widely distributed

We hope you find this Report useful in your efforts to address these critical needs.

THE INNOVATOR AND DEAL LANDSCAPE

Summary

Background – The Lifeblood of the Circular Carbon Economy

As the importance of directly mitigating CO2 emissions has increasingly come into focus in the last several decades, a number of companies started to explore potential “Carbon Capture and Storage” (CCS) solutions. Given that this involved tying into large power and industrial plants at an 8 or 9 dollar figure cost, most of these early actors were large, well capitalized, energy infrastructure companies such as GE, Siemens, Mitsubishi, and others. For a number of reasons (capital intensity, regulatory uncertainty, political controversy, among others) the conventional CCS market has moved along at a relatively slow pace, with less than 20 CCS facilities in operation worldwide today.

About 10 years ago, a number of more entrepreneurial players started to explore alternative approaches to both capturing CO2 and figuring out what to do with it in the absence of widespread regulatory requirements for sequestering it underground. These focused in particular on building profitable businesses by turning the CO2 into products the market values, such fuels, fertilizers, polymers, chemicals, building materials, food, and more.

Data Snapshot

332

Companies

27

Countries

$2.2 Billion

Capital Raised

132

Deals Tracked

$714 Million

Investment Opportunity

We are embarking on one urgent step in… incentivizing a clean and positive energy future.

Recognizing that risk takers are the lifeblood of any new human endeavor, the XPRIZE Foundation launched the Carbon XPRIZE in 2015, which was specifically designed to accelerate innovation in the space by offering $20MM in incentives prizes for new, effective capture and utilization solutions. Out of several hundred applicants, 23 companies were chosen as semi-finalists and ten of them have now moved on to become Finalists, vying for the grand prizes (to be decided in 2021).

Prior to the launch of the Carbon XPRIZE, there were no widely known list of companies in the emerging “Carbontech” space. No one really knew how broad and deep the innovator landscape was beyond those 23 companies deemed serious enough to compete. This was one of the core reasons we launched the Circular Carbon Network. It was clear that investment and commercial interest in the space was going to be limited until the market understood whether there was a there there in the solution landscape, in terms of quantity, quality, technical and commercial status, and other key factors that inform and motivate larger market activity.

Overview of the Innovator Index and Deal Hub

CCN developed the Innovator Index and its companion database, our Deal Hub, to address these critical gaps in information about the solution provider landscape for potential investors, commercial partners, and other key stakeholders. While the Innovator Index is focused on characterizing the rapidly evolving and growing solution provider landscape across a broad variety of practical, technical, and commercial dimensions, the Deal Hub is designed specifically to address the needs of capital providers and features investor-relevant information about live investment opportunities in the space. Together, our objectives for these companion database are:

- Help investors find circular carbon companies that fit their thesis

- Help entrepreneurs feature their company to a capital and commercial audience

- Help corporates identify potential startup innovation partners and suppliers

- Help entrepreneurs identify complementary solution providers and collaborators

Both databases include data gathered directly from companies via targeted surveys and through the review of public information by our research team. Because of our US location and the US and European location of many of our data partners, these databases are weighted towards North America and Europe, though we are working to expand our coverage of innovators from other global regions. We welcome your nominations of companies to add to the Innovator Index or Deal Hub. Despite these limitations, we believe we have compiled the largest public databases of Circular Carbon innovators and deals, ever. We hope you find them, and our analysis of the data we have gathered so far below, useful.

My motivation for starting this company is to solve climate change and contribute to the portfolio of solutions. The best way to drive social and technological change is to start in markets where you make something people need and want.

Key Findings

As we detail below, the Circular Carbon innovator landscape is diversifying and growing rapidly. While it is still early days in the evolution of this space, there is definitely a there there in terms of overall entrepreneurial activity. There is a broad spectrum of companies from around the world developing and commercializing a highly varied range of innovative Circular Carbon products and solutions for applications in different end markets. Moreover, even though the sector is still relatively young, there are meaningful numbers of companies at all stages of technology maturity, commercial deployment, and revenue generation, from new startups doing their first pilots to successful, growth-stage businesses. The same is true for the increasing depth and breadth of the investment opportunities we are seeing on the Deal Hub, where we find a diversity of deals across investment stages, type and size of investments sought, valuations, target investors, and other key factors. There are growing opportunities for a wide variety of investors.

Some of the key highlights of our analysis of the data in the Innovator Index and Deal Hub include:

Overall

- Increasing Pace of Company Formation: 62% of the companies on the Index were founded since 2010. At the same time, nearly 40% were founded before 2010; this sector is growing rapidly, but is neither as immature or as young as the casual observer might assume

Technology Dimensions

- Diverse Product Pathways, with Some Clear Leaders: While there are dozens of product pathways listed, Fuels (20%) and Chemicals (19%) are clearly the most common, followed by Building Materials (15%)

- Several Dominant Macro Technology Pathways: Again, while companies are pursuing many technology pathways, Biological processes dominate (30%), followed by Electrochemical processes (24%) and Thermal processes (23%)

- Technologies Maturing in Readiness: Using U.S. D.O.E. Technology Readiness Levels, a majority of companies that reported this information 58% (78 out of 135) classified themselves as somewhat technologically advanced; nearly half of those (38 of 78) classified themselves as highly advanced

Commercial Dimensions

- Companies also Maturing in Commercial Readiness: 34% of the companies whose commercial stage we were able to classify are in the “Commercial Demo” phase,followed by those in the “Growth” phase (26%), and the Pilot phase (23%),

- Beginnings of Revenue Traction: Of the companies for which we have revenue information (107 / 332), over half are generating revenue, and more than 50% of those firms are generating over $1M; another 44% are still pre-revenue

- Top Target Customers are Energy- and Carbon-Intensive Industries: The Oil & Gas, Chemicals, Utilities, and Building Materials industries are the leading customers industries for companies in the Index, though they are also seeking to serve a broad spectrum of other industries

Capital and Investment

- Capital Starting to Flow into the Sector: We found 135 companies that had raised nearly $2.2 billion, which is $200MM more than a year ago. While positive and likely significantly understating the total amount invested in the sector given geographic gaps in our data, it is still small relative to the need (and opportunity).

- Diverse Sources of Capital: Angels & Family Offices are the most common source of capital (32%, combined), followed by Government (22%), and Corporates (18%). While venture capital, and private equity are also prominent sources, there is a clear pattern of non-institutional investors taking the lead in financing the sector

- Increasing Deal Flow: Our Deal Hub has tracked 132 companies raising a total of $714,000,000 in the last year, a significant increase from when we launched the Deal Hub in 2019

- Spectrum of Investment Stages, Weighted to Early Stage: Investment opportunities span the full range of investment types (equity, project finance) and stages, with Seed and Series A deals the most common. However, 30% of all deals are also for later stage opportunities.

- Broad Spectrum of Investors Sought: Family Office and Angel investors (combined) are the leading target investors, followed by Corporates and Venture Capital.

- Round Sizes Still Modest: Round sizes are clustered in the sub-$20MM range, with the most common raises being between $2MM and $10MM.

- Valuations Still Modest Too: The largest number of companies are valuing themselves at between $10-$15MM. 40% are below this range, and 60% are at or above. Total stated valuations (based on only partial company data) add to over $1.5 billion. These modest valuations compared to the total market opportunity should make the sector increasingly attractive to investors

Data Highlight – Most Popular Circular Product Pathways

Detailed Analysis

Innovator Ecosystem - The Basics

How We Define an “Innovator”

Since the core goal of both the Innovator Index and Deal Hub is to accelerate the smart flow of capital and commercial activity in the Circular Carbon sector, we define an “Innovator” for both these Indexes as companies that have developed a technology or solution that is directly relevant to the Circular Carbon Economy that they are actively trying to capitalize and/or commercialize. Thus, we do not generally list pure academic or research projects, unless they seek to become commercial. Nor do we generally cover here the internal research efforts of large corporates (these can be found in our Corporate Index), unless they seek to commercialize specific solutions through a dedicated business unit or subsidiary. While the archetypal “innovator” in the Innovator Index and Deal Hub is indeed generally a “start-up,” it is important to recognize that the companies in these databases actually come in all shapes and sizes and stages.

A Sampling of Companies in the Innovator Index & Deal Hub

To provide just a flavor of the Innovator and Deal landscape we are tracking, here is a sampling of the solution providers in the Innovator Index and Deal Hub (all companies on the Deal Hub are also included on the Innovator Index, though the opposite is not true). It is diverse in many dimensions captured here and beyond:

CARBON CAPTURE

(From Flue Gases)

CO2 capture from point sources like power plants, steel facilities

Example: Svante

CARBON CAPTURE

(Directly from Air)

CO2 capture from the atmosphere

Example: Global Thermostat

CARBON-TO-VALUE

(Materials)

Conversion of carbon into novel and advanced materials like carbon nanotubes

Example: C2CNT

CARBON-TO-VALUE

(Fuels)

Conversion of carbon into fuels like synthetic diesel, jet fuel, or gasoline

Example: Breathe

CARBON-TO-VALUE

(Chemicals & Polymers)

Conversion of carbon into plastics and chemicals

Example: Newlight

CARBON-TO-VALUE

(Food & Ag)

Conversion into agricultural inputs (e.g. fertilizer) and products (e.g. proteins)

Example: Soil Carbon Co

GEOLOGIC STORAGE

Capture and removal of CO2 via geologic storage

Example: Climeworks

BIO-BASED REMOVAL

Harnessing bio-based processes to durably sequester CO2

Example: Charm Industrial

GEO-BASED REMOVAL

Harnessing geo-based processes to durably sequester CO2

Example: Project Vesta

Increasing Company Formation

In a very positive sign for the trajectory of the sector, we observe significant growth in the number of Circular Carbon companies founded in the last ten years. Specifically, 62% of the companies for which we have founding year information were founded after 2010.

Leading Geographies to Date

The companies on our Index come from 27 different countries around the world. These are weighted heavily toward North America — 52% are from the US and almost 10% from Canada alone — and Europe, which has 32% of the total, with Germany and the UK at the top of the list.

Expanding Our Coverage

It is clear from these numbers and the map below that we have more work to do in sourcing innovator and deal data from other critical geographies around the world. We are almost certainly missing important additional entrepreneurial activities in the sector in Asia, Africa, the Middle East, and South America. The good news is that the magnitude, depth, and breadth of innovation in the sector is likely significantly larger than even the already rich landscape our Innovator Index reveals. We are committed to expanding our coverage and welcome your help in identifying innovators from these regions that should be on our Index or Deal Hub. You can nominate companies here.

Map of Company HQ Countries in the Innovator Index

Technology Dimensions

Carbon Technology Categories

When tracking the types of technologies being pursued by companies in the Circular Carbon sector, we established a framework that included several macro categories: (1) Capture & Utilization; (2) Utilization; (3) Capture (Flue) (4) Capture (Direct Air) and( 5) Other. Our initial rubric was oriented more towards “Carbontech” companies and less on “Carbon Removal” companies, which overlaps with Carbontech in various ways, but also includes less technologically-driven biological and geological approaches. We plan to expand our categorization rubric to more fully and clearly encompass these Carbon Removal pathways, but for now they are marked as “Other” in the analysis below.

Per the chart above, the highlights of our Carbon Technology Category analysis include:

- Capture & Utilization: Over 41% of the innovators we were able to categorize are pursuing both capture and utilization

- Utilization Only: Another 24% are pursuing carbon utilization only

- Capture Only: Over 21% are carbon capture only (10% are focused on flue gas capture and 11.4% are focused on Direct Air Capture, broadly defined)

- Other: Nearly 13% are pursuing other types of circular carbon approaches, including biological and geological carbon removal, among others

The fact that a plurality of companies on the Innovator Index are pursuing both capture and utilization may indicate that there are technological and/or commercial advantages of doing so. We plan on examining this more closely in the future.

Product Pathways

Looking at the macro category of product that is being made by companies on our Innovator Index (versus the macro category of technology that is making it, per the above), we find a quite diverse mix of product pathways. Fuels (20%) and Chemicals (19%) are clearly the most common products, followed by Building Materials (15%). But there are significant numbers of companies pursuing the other product categories listed below as well as several product types that don’t fit neatly into these categories (you can find more granular data here).

Specific Product Examples

The examples below illustrate an incredible diversity of different types of specific products being developed or produced by innovators in the Circular Carbon sector:

Edible proteins

Biodegradable packaging

Organic crop nutrients

Vodka

Ultra-high purity ethanol

Fragrance

CO2

Diesel

Jet Fuel

Biochar

Zero-emissions power

Magnesium bicarbonate

Diamonds

CO2 removal certificates

Methanol

Key Process Types

Here we track and categorize the key technology processes being used by the companies in the Index to produce their products. Interestingly, of those companies whose underlying technology process we were able to clearly categorize, Biological processes dominate (30%), followed by Electrochemical processes (24%) and Thermal processes (23%), and a diversity of others.

Core Innovations

Like entrepreneurs in every sector, the companies in the Innovator Index are working to bring differentiated, advantaged solutions to market. We asked each company on the Index to describe their “core innovation” both to help us understand and categorize them as well as to help potential investors and commercial partners evaluate the advantages of a particular company’s approach. Here are just a few examples of companies’ core innovations in their own words…

Direct Removal and Conversion

“C2CNT produces carbon nanotubes and eliminates CO2 without the need for any pre-concentration of the CO2 exhaust stream. C2CNT’s process is inexpensive relative to conventional CNT production methods.”

Accelerated Mineralization

“Neustark produces containerized technology to turn CO2 into minerals inside the pores of demolished concrete.”

Biochemistry

“Novomer’s production of bio-chemicals is very cost-efficient. The technology platform utilized has a selective chemistry efficiency of >99.8% and produces no by-products. These efficiencies allow for a wide variety of bio-chemicals and polymers to be priced competitively with their petrochemical based equivalents.”

Collaborative Innovation

“The combination of Liquid Light’s expertise in electrochemistry with Avantium’s expertise in catalysis and process engineering will be the basis of an unrivaled technology platform to develop novel production technologies for converting CO2 to chemicals and materials.”

Technology Readiness Levels

To assess the technology readiness of the emerging companies in the Circular Carbon sector, we asked companies in the Index to classify themselves using the same Technology Readiness Level (TRL) framework employed by the U.S. Department of Energy.

At a high level, TRL levels 1 – 3 describe early lab-scale innovation, TRL levels 4 – 6 describe solutions that are transitioning into both laboratory and industrial pilots or proofs of concept, and TRL levels 7 – 9 describe solutions that are entering the market through to those that are fully mature and commercial.

With the important disclaimer that this is self-reported information, we were surprised to find that companies in the sector may be more technologically mature than commonly assumed:

- A clear majority of 58% (78 out of 135) classified themselves as somewhat technologically advanced or more, at TRL level 6 or above.

- Of those, nearly half (38 of 78) classified themselves as highly advanced in development at TRL levels 8 or 9

- As expected, there are also significant number of companies (57) at lower TRL’s (1-5)

At one level, however, these findings should not be that surprising. Per our Company Vintage data above, about 50 of the companies on our Index were founded before 2010. These companies and others have had over a decade of time to develop and refine their solutions. Many of these are now ready for deployment and scaling. This sector is neither as immature or as young as the casual observer might assume.

Commercial Dimensions

Commercial Stages

Moving into characterizing the commercial status of the companies on the Innovator Index, we categorize them according to the stages listed below. With the disclaimer that this information is based on a mix of self-reported data by the companies themselves and classifications by our research team using public information (where available), we found that the largest segment of companies for which we have this information in the Index are in the “Commercial Demo” phase (34%), followed by those in the “Growth” phase (26%), and the Pilot phase (23%). That means that almost 85% of the companies that we are tracking this information for are actively commercializing or are already commercial. The remainder are mostly still in the R&D phase, with a handful on the other side of the spectrum being classified as “Mature” companies (with large, established businesses). While this data shows that the companies on the Index are still generally weighted toward the “early stage” of commercialization, the Circular Carbon solution provider landscape is by no means dominated by research-focused, pre-commercial efforts.

Revenue Ranges

Evaluating revenues, we also see the beginnings of revenue traction across the sector. Of the companies for which we have revenue information (107 / 332), over half are generating revenue, and more than 50% of those firms are generating over $1M. While those companies are breaking out into their growth phase, 44% are also still pre-revenue. This shows again that while the sector is still generally early stage in the largest sense (and thus should offer opportunities with attractive valuations for earlier stage investors), there are signs of real commercial traction and growth (and, in turn, there should be opportunities for investors interested in more mature companies).

Target Customers

To understand the current and potential customer bases of the solution providers in the Index, we surveyed companies about their target customer industries. We found they are seeking to serve a highly diverse array of industrial sectors across the global economy. The Oil and Gas and the Chemicals industries top the list, which is not surprising given that these sectors’ core businesses are not only energy and carbon-intensive — they are focused on carbon-based molecules. Many of the other leading target industries are also carbon-intensive or have challenging pathways to directly de-carbonize (e.g., cement and steel).

These top target customer industries also accord with the top Product Pathways being pursued by companies on the Index as identified above (Fuels, Chemicals, Building Materials) as well as the sector distribution of global companies in our Circular Carbon Corporate Index, where the leading industries represented on the Index are Oil & Gas, Utilities, Chemicals, and Construction Materials.

Commercial Needs

Our Indexes are not just intended to inform, but also to facilitate cross-industry collaboration and action. We ask the solution providers in our Innovator Index to list and categorize their current top commercial needs to help us and other market participants identify potential partnership opportunities.

As shown below, companies on the Index are seeking a variety of commercial partners, with a focus on customers and project hosts.

Examples of Commercial Needs Expressed by Innovators

Here are several examples of the specific needs technology developers on the Index told us they have in their own words. They are highly varied and very evocative of entrepreneurial businesses working to build their foundations for growth:

Offtakes

“Suppliers of CO2 are plentiful and eager to engage. Rapid commercial roll-out of new facilities hinges on offtake partners for the algae.”

Licensees

“We are looking to establish strategic partnerships to further our commercialization. Also looking for licensing opportunities for the technology.”

Guarantees

“In the past 12 months, we have experienced 350% growth with product now shipping across 6 countries. We are looking for commercial financial / product guarantees solutions that could help us grow further.”

Manufacturing

“We’re interested in finding additional partners to help with toll/contract manufacturing as we scale up, as well as mission aligned brands and retailers looking to replace single-use petroleum-based plastics in their ecosystem with more sustainable, closed-loop materials.”

Regulations

“We need regulations that encourage our innovative technologies and allow industrial emerging CCU solutions on a sustained basis to reach a competitive price level with current industrial uses that do not take enough into account negative externalities in the economic models”

Modularity of Solutions

Another significant commercial factor we evaluate is the modularity of the solutions provided by Companies in the Index. While there are ongoing debates about which level of modularity is ideal, it clearly depends on the context. Highly modular solutions can be deployed and distributed at multiple scales and still be cost effective. Less modular solutions can also be extremely profitable and impactful at large scales (which we ultimately need to get to). Like the solar industry (which has very distinct approaches across residential, commercial & industrial, and utility scale applications), we are likely to see a range of sizes of deployments that make sense for circular carbon solutions.

So far, for the companies in our Index who provided us with the relevant information, modularity is far more common than not:

Co-Location Requirements

Another related factor in the nature and speed of the deployment of the Circular Carbon solutions is whether they need to be co-located with existing industrial plants. Again, there are pros and cons. Existing industrial facilities emit most of the world’s CO2 emissions and arguably have the most need for Circular Carbon solutions. They also possess many of the infrastructural foundations that Circular Carbon companies need — heat, power, and CO2 itself, among many others. On the other hand, integrating with existing industrial facilities can be complicated and expensive and trigger both institutional and regulatory barriers.

Per the below, over 45% of the companies who supplied this information (92) stated that co-location is optional or not applicable, while over a third said it is required.

Capital Sources

Capital Raised to Date

A critical question we sought to answer in building the Innovator Index was – how much capital has been invested in the sector to date? Our results provide just a partial answer. We were only able to identify investment-to-date totals for 135 out of the 332 companies in the Index. This totaled nearly $2.2 billion, which is not insignificant. This also compares favorably to the $2.0 billion raised by 89 companies that we tracked when we first launched the Innovator Index in September of 2019. Thus, we have identified an additional $200 million raised in just the last year.

However, these numbers likely significantly understate the amount of capital that has flowed into the sector to date for a number of reasons. First of all, our data only covers 40% of the companies in the Index. A linear projection of the amount raised by those 135 companies for whom we have capital raised data to the full 332 companies in the Index, suggest a projected total of over $5.4 billion. While this may not be a conservative estimate, also remember that our Index itself, as noted above, has significant gaps in coverage regarding technology developers in most major regions outside of North America and Europe, including Asia, the Middle East, South America, and Africa. While it is conjecture to venture a total amount of capital that has gone into the sector so far, we know it is at least $2.2 billion, and very likely substantially more.

Capital Raised by Region

Although clearly biased by our over-weighted coverage of North America in general (our home territory), companies in the Index from North America raised by far the largest amount of capital to date.

Top Sources of Capital

As clearly outlined in our Capital Index, there is an increasingly broad variety of capital providers starting to invest in the Circular Carbon sector. When we measure the top sources of capital to date for the Companies in the Index, three investor classes clearly stand out. Of all companies in the Index for which we have capital source information (207 companies), the most common sources are: Angels and Family Offices (32% combined), Government (22%), and Corporates (18%). While venture capital, and private equity are also prominent sources, there is a clear pattern of non-institutional investors having taken the lead to date in financing the sector. This is not surprising for an emerging industry, but also highlights that the sector may still have some work to do to attract more conventional investors. In the meantime, companies in the sector clearly seem to appreciate the role that these early investors have played…

Patient family office capital was a real hero for us.

Sample Investors

Bill Gates

Grantham Foundation

Baruch Future Ventures

Kapor Capital

Lowercarbon Capital

Zero Carbon Partners

National Science Foundation

Federal Government of Canada

Korean Government

Spanish Government

Chevron Ventures

NRG

Occidental Petroleum

Oil & Gas Climate Initiative

Saudi Aramco Ventures

Breakthrough Energy Ventures

Techstars

Chrysalix Ventures

Evok Innovations

Roda Group

Lionheart Ventures

Investment Opportunities

About the Deal Hub

The CCN Deal Hub tracks live opportunities in the Circular Carbon sector to inform and facilitate investor investments in the sector. There is no cost to be listed or fees of any kind to any parties at any point in relation to investment opportunities that are listed. However, only Accredited Investors may access the Deal Hub.

We want to seed the next generation of climate technologies and the Deal Hub helps us identify them.

The Deal Hub lists both “corporate” investment opportunities (investments into companies) as well as project investment opportunities (investments in specific deployments), though to date, as shown below, it has been weighted toward corporate-type investments.

The information on the Deal Hub is supplied by the offering entity (e.g. start-up or company or project sponsor). Once a deal has gone 60 days past the “Anticipated Closing Date” as indicated by the company, it is moved from the “Active Deals” list to the “Historic Deals” list.

Total and Current Investment Opportunities Tracked

The Deal Hub was launched in September 2019. At that time, we identified 51 companies raising approximately $430,000,000. Over the last year, we have identified a significant amount of additional investment opportunities, with the Deal Hub tracking 132 companies raising a total of $714,000,000 during that period. As of the publication of this report, 58 companies raising approximately $307,000,000 are listed as Active Deals on the Deal Hub. In sum, we are seeing an ongoing, increasing flow of live investment opportunities in the sector.

Type of Capital Sought

The companies in the Deal Hub are raising a fairly typical spectrum of types of capital for an emerging technology sector. Corporate Equity is by far the most common, followed by Convertible Debt (which is often used by early stage companies to bridge to the next priced round). It is good to also see a significant number of companies (67) seeking Project Equity and Project Debt, which is a sign that companies in the sector are actively working to finance commercial deployments of their solutions.

Deal Investment Stages (Series)

While the investment opportunities listed in the Deal Hub span the full range of stages, a large majority of the deals are for earlier investment stages (series), with Series A leading, followed by Seed stage deals. It is worth noting, however, over 25% of the “Series A” deals listed are for over $10 million, which is on the high side for the typical Series A. In addition, 40 deals (over 30% of the opportunities listed on the Deal Hub) are later stage deals or listed as “Other” than these earlier stages (examples include companies raising “growth” equity). The bottom line, however, is that the bulk of the capital raises we tracked over the last year are for earlier stage deals. With more than 60 companies formed from 2015 – 2019, early-stage deal flow makes sense given the accelerating velocity of new startups emerging.

Broad Spectrum of Investors Sought

Companies in the Index are also seeking capital from a broad variety of capital providers. Family Office and Angel investors (combined) are the leading target investors, followed by Corporate Strategics and Venture Capital (note: companies are able to indicate their preference for multiple target investors in the Deal Hub). This largely aligns with the historic sources of capital for companies in the Innovator Index as described above (Family Offices and Angels, Corporates, and Government) though, interestingly, the Government has somewhat dropped in preference for current deals versus historic deals. It also reinforces again that investors with generally longer time horizons (family offices) and strategic objectives (corporates) are preferred (and perhaps more inclined) targets for Circular Carbon innovators than pure institutional, financially-oriented investors for the moment.

Round Sizes

There is also a relatively broad range of round sizes represented in the Deal Hub for check writers looking to deploy different amounts of capital. The raise sizes are clustered in the sub-$20MM range, with the most common raise sizes being between $2MM and $10MM.

Valuation Ranges

While we only received pre-money valuation information from a portion of companies on the Deal Hub (71/132) , it provides some interesting context on the valuation patterns in the sector (largely pre-Covid, it should be noted). The largest number of companies are valuing themselves at between $10-$15MM. Forty percent of all deals are below this valuation, and roughly 60% are above. In total, the stated pre-money valuations of this portion of the companies on the Deal Hub summed up to over $1.5 billion.

I see investing in this space at an inflection point. A few years ago it was too early and in a few years, people will be priced out because these companies are going to be too valuable

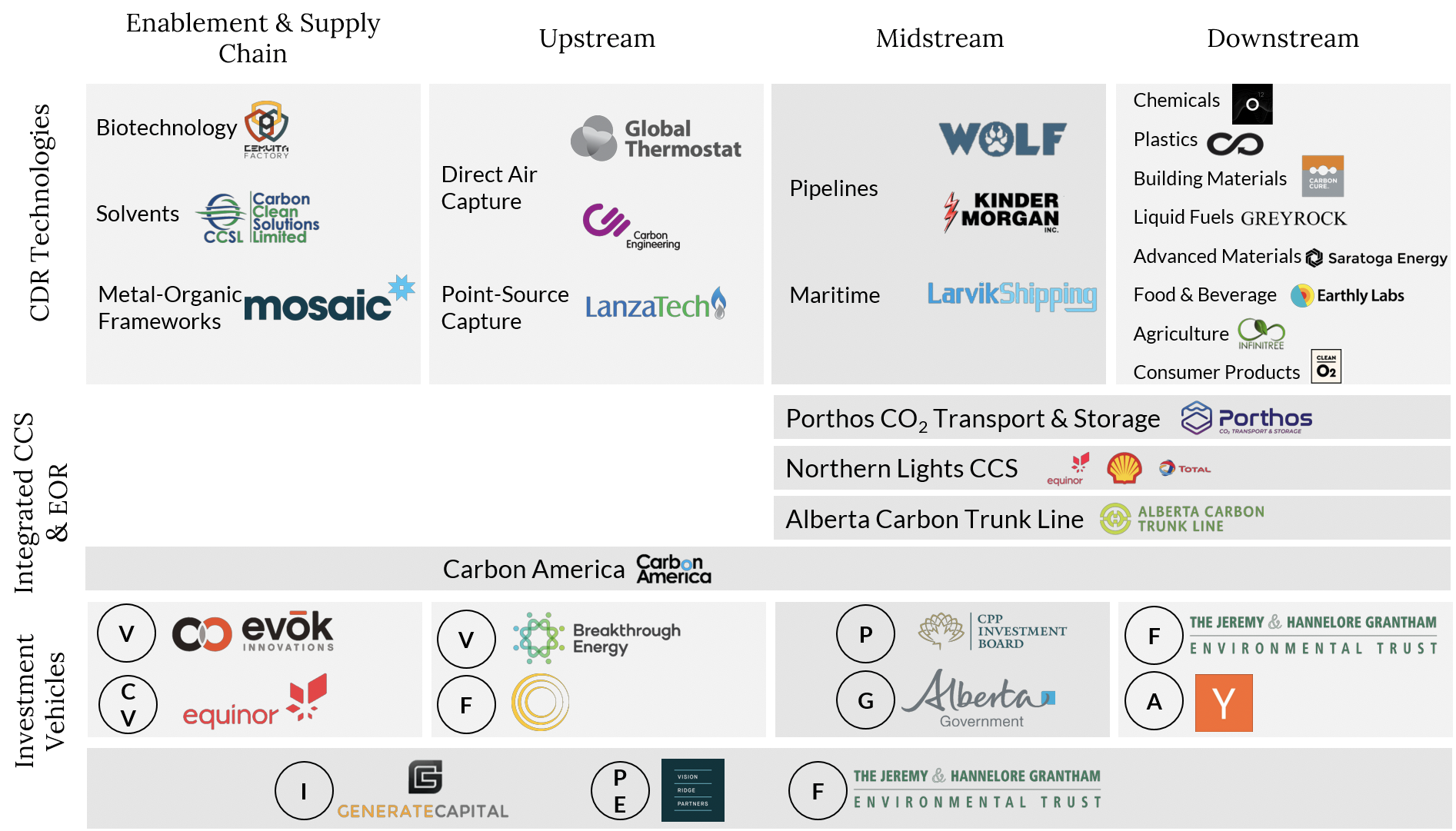

Investment Landscape Summary

Our partners at the CREO Syndicate (a non-profit network of family office and aligned investors interested in clean economy opportunities) developed the rubric below to describe the Circular Carbon investment landscape. It sensibly divides the space horizontally by proximity to the end use of the carbon molecule, starting with Supply Chain opportunities as the farthest out (to the left), and then upstream opportunities (carbon capture), midstream opportunities (CO2 transportation and distribution), and downstream opportunities (carbon-to-value, carbon removal) to the right. On the vertical access, it has capture, utilization, and removal opportunities on the top row, with integrated CCS and EOR opportunities below, followed by Investment Vehicles on the bottom (for more context on the investor space, see our analysis of our Capital Index).

If our analysis of the various dimensions of the Circular Carbon innovator and deal landscape above haven’t made it clear already, this chart should help you visualize the rich (and growing) diversity of investment opportunities in the sector.

CREO Syndicate Digest of the Circular Carbon Landscape

THE INVESTOR LANDSCAPE

Summary

Background – The Critical Importance of Capital

As the threat of climate change has come into focus, the question of how to finance solutions has become more urgent. An initial burst of venture capital interest in “cleantech” companies in the late 2000’s largely fizzled due, among other reasons, to the Great Recession and the mismatch (both real and perceived) between the time-bound and capital-limited venture model and the long development cycles and capital intensity of new energy and infrastructure solutions. Nearly 15 years have passed since that first cleantech “bubble” and some of the same challenges remain. However, the threat of climate change is no longer theoretical; we are now seeing its effects all around us. In response, as you will see below, a more diverse set of capital providers — from family offices, to corporates, to governments — are getting engaged in financing “clean economy” solutions. In addition, a growing number of these investors are bringing longer term capital and an “impact” lens to their investment strategies. In concept, the Circular Carbon economy — where you recycle or remove CO2 in the process of creating economic value — offers investors a compelling way to twin economic returns with climate impact (see our Market Reports Library for a compendium of third party assessments of both the climate and market potential of Circular Carbon solutions). Indeed, some would argue that replacing our linear fossil carbon economy represents one of our best opportunities to renew global prosperity, reinvent the economy, and create a more resilient and just society. Still, the amount of time we have to achieve this vision is short and the scale of capital required is large.

Data Snapshot

122

Firms

12

Countries

$195 Billion

Assets Under

Management

Overview of the Capital Index

The CCN Capital Index tracks capital providers who are currently active or interested in circular carbon investment opportunities. It also tracks other leading (mostly clean technology-oriented) investors who are not yet active, but whose mandates or focus suggest they could (and perhaps should) be.

Raising capital is challenging during the best of times. This is especially true for an emergent, capital-intensive sector that is establishing itself in the midst of a global pandemic and other geopolitical and geophysical challenges. By tracking a broad range of data about the investment profiles, preferences, and performance of capital providers active or interested in the sector, our goal is to accelerate and increase the smart flow of capital into the Circular Carbon economy. Specifically, the Capital Index is designed to:

- Help investors build syndicates and identify potential co-investors across stages

- Help investors identify potential sources of follow-on capital

- Help Limited Partners find funds active in the carbon sector

- Help entrepreneurs find potential sources of capital across asset classes (e.g. equity, project finance, grants, etc.)

- Help strategic corporate VCs identify institutional investors to collaborate with

The data for the Capital Index was compiled from a mix of direct responses by capital providers to a structured series of questions and a review of publicly available information by our research team. It currently includes 122 clean technology-oriented capital providers of all types (from individuals to venture and private equity firms to project finance firms, corporates, and more) from 12 countries (primarily North America and Europe), representing more than $195 billion in assets under management (AUM). It’s still a relatively small slice of the global capital pie, but we believe it represents the largest and most detailed database of Circular Carbon-curious investors ever compiled.

Investor Interest in Circular Carbon Opportunities is Growing

The transition to a sustainable economy represents the largest investment opportunity we have ever seen particularly for businesses that can contribute to the reversal of global warming.

Key Findings

The emerging Circular Carbon investor landscape is already quite diverse and includes a broad range of types of investment institutions, types of investments, and size of investments. It also appears to be growing in size, with well over a third of all investment firms we are tracking having been founded in the last five years. Overall, the firms in the Index are managing a significant amount of capital and express a surprisingly high level of general interest in a wide spectrum of Circular Carbon opportunities. However, the lack of specialization and the somewhat limited amount of capital actually deployed into the sector to date indicates that there is significant room for growth. All of these different factors can be filtered and viewed in the Capital Index here.

Data Highlight – Significant Investor Interest in Carbontech

Some of the key highlights of our analysis include:

- The Circular Carbon Investor Landscape is Growing: Over 58% of all investment firms on the Index were founded with the last ten years

- Early Stage Investors Still Dominate: Not surprising for an emerging sector, venture firms doing pre-Seed through Series A investments make up a majority of the Index; The median investment size is a little over $5MM

- Investors Are Open to No or Low Revenue Companies: A majority will look at pre-revenue companies or companies with less than $5MM in revenue

- Significant Interest in Carbontech: Over 56% indicate that investing in “Carbontech” is a core focus or something they currently consider

- CO2-to-Concrete Popular, EOR Not: Carbon-to-building materials is currently the most popular carbontech focus area; Enhanced Oil Recovery is the least; However, investors are open to a broad spectrum of Carbontech solution pathways in between

- Growing Interest in Carbon Removal: Nearly 51% indicate that “Carbon Removal” investing is now an area they are active or interested in

- Direct Air Capture Top Carbon Removal Focus Area: Direct Air Capture (DAC) to durable carbon-based products tops the list of current investor interest in carbon removal, followed by soil carbon sequestration, biochar, Bioenergy with Carbon Capture and Storage (BECCS), and DAC to geologic sequestration.

- Capital Starting to Flow, But More (Data) Needed: 21% of investors in the Index stated they have already deployed capital into the Circular Carbon Sector across deals totalling $130MM; private equity and family offices/angels lead, having invested $50M and $34M respectively, followed by corporates and venture capital (approximately $20MM each) and foundations ($7MM); This significantly understates the total investments in the companies we track in the Innovator Index ($2.2B). We clearly need to improve our coverage here. We welcome your updates to our data.

Detailed Analysis

How We Define a “Capital Provider”

The purpose of the Capital Index is to track and facilitate the deployment of capital into the Circular Carbon economy. Thus, our definition of a “capital provider” encompasses any firm or entity (public, private, non-for-profit, otherwise) that is directly deploying capital or is directly advising capital providers on the deployment of their capital into the sector. This includes, for example, common investor types such as venture capital, private equity, and project finance firms as well as family offices, corporations, foundations, and governments, among others.

Growing Climate Investment Ecosystem

Despite current headwinds caused by COVID-19, “Climate Tech” as a theme is taking hold with key stakeholders. Circular Carbon categories like Carbon-to-Value, Direct Air Capture, and Carbon Removal are growing in visibility for everyone from American politicians in both parties to environmental NGOs to some of the world’s largest investors and path-breaking entrepreneurs. As detailed in our Corporate Index, companies like Stripe, Delta, Microsoft and now Amazon are stimulating demand for Circular Carbon solutions, as the companies detailed in our Innovator Index and beyond continue to prove out their technologies. While angel investors and family offices picked up some of the slack left in the wake of the cleantech bubble bursting 2008, new momentum is now also coming from Silicon Valley, Wall Street, and big corporates. Our Capital Index endeavors to put some more color, context, and actionable data behind these trends.

Investor General Info

Types of Investment Institutions Represented

Venture capital firms dominate the Index to date, representing nearly 60% of all firms we are tracking, followed by private equity firms (25%), family offices and angels (18% combined), corporate investors (13%) and a diversity of other types of institutions. This likely reflects the still-nascent state of the circular carbon sector, with earlier stage investors generally being more active in the sector so far.

Firm Vintages

The overall Clean Technology investor landscape appears to be growing again, in both numbers of firms and assets under management. While many of the newer investors may use terms other than “cleantech” to describe their focus (versus “Energy Tech” or “Carbontech” or “Climate Tech”), the Index shows an increasing variety of capital providers have entered the space in recent years at a growing pace. Specifically, over 58% of all investment firms we are tracking having been founded in the last ten years, with over 28% founded in the last 5 years (with one of those five years highly impacted by Covid-19 and still unfinished as of the writing of this report).

Countries Represented by Investors in the Index

Investment firms headquartered in 12 different countries are represented in our Capital Index. The vast majority (69%) are based in the U.S. The rest are mostly based in Europe (14%), and Canada (4%), with a small number from Asia and the Middle East. This is in significant part a reflection of our location, familiarity, and ease of data access. We are committed to expanding our research coverage to these and other important global regions and welcome the help of our Network and partners to bring data about investment activities in these areas to our attention. You can access the form to nominate a capital provider for our Capital Index here.

Types of Investments Made

The capital providers in the Index are deploying a fairly broad range of types of investments. Reflecting the dominance of venture and private equity firms, corporate equity and convertible debt are the most common investment types, followed by project equity and debt, and corporate debt. There are also a meaningful number of firms that indicated they are making Mission Related Investments (MRI’s), Program Related Investments (PRI’s), and grants, reflecting that there are several foundations and family offices with philanthropic arms in the Index.

Representative Investors Descriptions

Established in 2015 by Bill Gates and a coalition of private investors concerned about the impacts of accelerating climate change, Breakthrough Energy supports the innovations that will lead the world to net-zero emissions.

True North invests in early-stage, disruptive innovations in energy, water, chemicals & fuels, and waste that could result in large, stand-alone companies that would play key roles in helping the world transition to a clean and sustainable future. True North has a unique, patient capital based with over $700 MM committed capital from four wealthy families in a perpetual, evergreen structure.

Prime Impact Fund invests in transformative technology companies with the potential for gigaton-scale climate impact. Drawing on catalytic capital with a long-term lens, the fund is purpose-built to support high-risk, high- reward, high-impact ventures at the earliest stages.

Generate is a diversified infrastructure company that partners with leading project developers to build and operate decentralized, decarbonized, digitized, and democratized infrastructure projects.

We invest in companies shaping the energy landscape of the future; A collaborative approach to innovation, bringing incumbents, capital and entrepreneurs together to shape the future of energy

We are a $110M fund that was formed by members of the Clean Energy Venture Group (CEVG) founded in 2005 to invest in early stage technology companies with the potential to make venture returns and reduce at least 2.5 Gt GHG (CO2e) by 2050.

Incite.org is a values-driven investor that provides catalytic capital and guidance for early stage start-ups, nonprofits, and activists doing good in the world. The Incite.org portfolio reflects the deepest emergencies and needs of our time: climate solutions, civic engagement, and world-positive innovation.

Lowercarbon Capital funds research and invests in technologies to reduce CO2 in the atmosphere.

Direct and/or Fund Investments

The majority of investors in the Index make “direct” investments only (investments directly into companies versus into funds). However, 20 (16%) say they also consider and make investments into funds. This is a positive indication that there is appetite and room for capitalizing new fund managers who might incorporate a Circular Carbon investment thesis into their approach.

Assets Under Management (AUM)

The firms in the Capital Index are currently managing a total of $196 billion dollars. This is heavily influenced, however, by two very large investors, TPG and Generation Investment Management, with $119B and $26B under management respectively. While those firms do allocate a minority portion of their funds to cleantech (including circular carbon) investments, the remaining investors manage a total of $51B between them. Excluding the outliers, the average AUM is $685 million, while the median is $215 million. The largest investor manages $6 billion, and the smallest $8 million.

Investment Stage Focus

Investors in the Index are deploying capital across many investment stages, from pre-seed to public equity. Much of the focus, however, is on the earlier stages, with nearly 47% doing pre-seed, seed, and Series A investments. A significant percentage (43%) are also deploying capital into later stages (Series B – E). In contrast, only 6% of the firms we are tracking are investing at the mezzanine stage or in public securities, and 4% are doing project investments. We hope to find and track more project investors active in the circular carbon space in the near term especially, as a robust project finance ecosystem will be critical for scaling and deployment.

Initial and Total Investment Size

There is a cluster of typical initial investment sizes for investors in the Index at the low end from $100K to $1MM and then again from $1MM to $10M, showing there is some investment size range and flexibility amongst potential Circular Carbon capital providers.

Meanwhile, the majority of Investors who responded indicated they could deploy from $1MM to $10MM into a single company over the life of an investment. Fifteen investors indicated they could commit a total of $10MM in a given opportunity. As the sector matures, we hope to identify more capital providers who can supply the increasing capital needed for its growth

Pre- or Post-Revenue Preference

Two thirds of the investors who indicated a preference said they always, regularly, or sometimes consider investing in pre-revenue companies. This is positive as it reflects the early stage focus of a significant percentage of investors in the Index (per the above) as well as the status of many of the emerging opportunities in the sector.

Target Company Revenue Range

Again reflecting the generally still-early stage focus of investors in the Index, the vast majority are targeting companies with revenues of less than $5MM (or pre-revenue altogether). Still, 37 also indicated they are targeting companies with revenues over $5MM as well.

Lead Preference

Most investors in the Index prefer to lead, with a similar number willing to either lead or follow. Very few prefer to follow. It’s positive that there are both willing price-setters in the market and some flexibility to follow given that it is unlikely that all investors in our Index have yet built up the diverse and sophisticated technical due diligence capabilities that evaluating circular carbon opportunities often requires.

Investor Geographic Focus – By Region

Following on the fact that most of the capital providers in our Index to date are headquartered in North America or Europe, most also say they are focused on investing in those regions. However, a significant number also indicate that they have a global investment lens. As we have stated elsewhere, we are working to increase the diversity of this and other Indexes and welcome your input on capital providers we should consider in that vein.

Investment Horizon

The investment horizon of the majority of investors in our index who indicated a timeframe is fairly typical for conventional institutional investors in general, clustered in the three to seven year time frame. We are starting to see, however, the emergence of longer term capital, with 20 capital providers indicating that their investment time horizon is seven years or more (including a small number with permanent capital).

Investor Focus Areas

Impact and Returns Focus

“Investing for impact” used to indicate a willingness to earn sub-market returns in exchange for having a positive impact on issues of concern. Today, there are many signs that impact investing both means more than that and is increasingly going mainstream. The expressed preferences of the investors in our Index reflect that, with the largest number of respondents on this issue stating that impact and returns were equal factors in their investment decision making and another significant group saying that impact is a core objective while they seek market returns. On the other hand, very few stated they are willing to take below market returns for impact. While there are still a substantial number who state that returns are their primary driver, these results suggest that investors are increasingly coming to the conclusion that impact and returns can and should be twinned. Overall, this is good news for the Circular Carbon sector, where most companies are working to create successful businesses while having a positive impact on climate change.

Impact Focus Highlights

Here are some examples of how different investors describe how they consider impact and returns when deploying capital: